We Think Nova MSC Berhad (KLSE:NOVAMSC) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Nova MSC Berhad (KLSE:NOVAMSC) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does Nova MSC Berhad Carry?

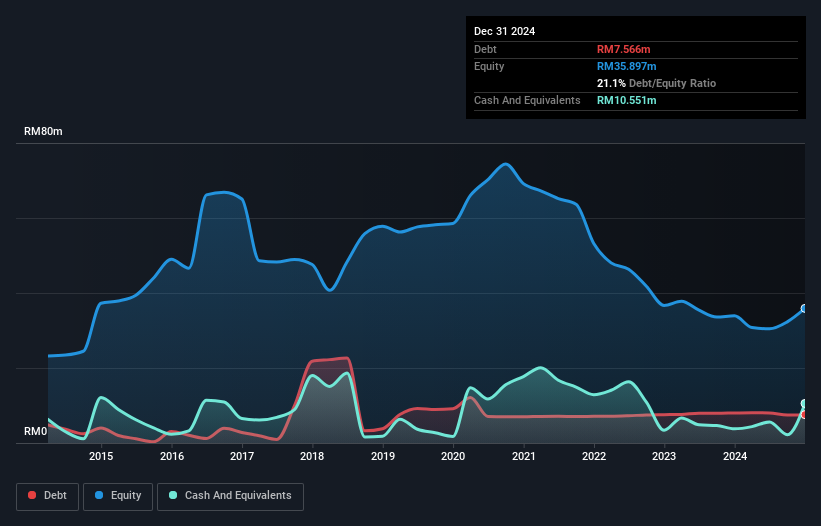

The image below, which you can click on for greater detail, shows that Nova MSC Berhad had debt of RM7.57m at the end of December 2024, a reduction from RM8.00m over a year. But it also has RM10.6m in cash to offset that, meaning it has RM2.99m net cash.

A Look At Nova MSC Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Nova MSC Berhad had liabilities of RM21.9m due within 12 months and liabilities of RM4.05m due beyond that. Offsetting these obligations, it had cash of RM10.6m as well as receivables valued at RM11.1m due within 12 months. So its liabilities total RM4.37m more than the combination of its cash and short-term receivables.

Of course, Nova MSC Berhad has a market capitalization of RM91.9m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Nova MSC Berhad also has more cash than debt, so we're pretty confident it can manage its debt safely.

See our latest analysis for Nova MSC Berhad

Notably, Nova MSC Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM182k in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Nova MSC Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Nova MSC Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, Nova MSC Berhad actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Nova MSC Berhad has RM2.99m in net cash. And it impressed us with free cash flow of RM1.5m, being 814% of its EBIT. So we don't have any problem with Nova MSC Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Nova MSC Berhad (of which 2 are concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Nova MSC Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NOVAMSC

Nova MSC Berhad

An investment holding company, engages in the software research and development, and provision of e-business solutions in Malaysia and Singapore.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026