Here's Why Nexgram Holdings Berhad (KLSE:NEXGRAM) Can Manage Its Debt Despite Losing Money

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Nexgram Holdings Berhad (KLSE:NEXGRAM) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Nexgram Holdings Berhad

What Is Nexgram Holdings Berhad's Debt?

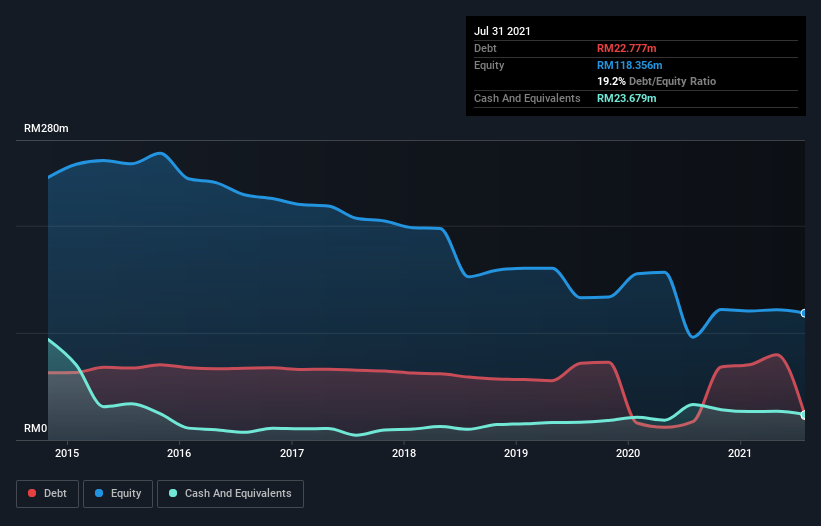

The image below, which you can click on for greater detail, shows that at July 2021 Nexgram Holdings Berhad had debt of RM22.8m, up from RM17.1m in one year. But it also has RM23.7m in cash to offset that, meaning it has RM901.5k net cash.

How Healthy Is Nexgram Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Nexgram Holdings Berhad had liabilities of RM31.1m falling due within a year, and liabilities of RM11.3m due beyond that. Offsetting this, it had RM23.7m in cash and RM51.5m in receivables that were due within 12 months. So it can boast RM32.7m more liquid assets than total liabilities.

This excess liquidity suggests that Nexgram Holdings Berhad is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Nexgram Holdings Berhad boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Nexgram Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Nexgram Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 82%, to RM75m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Nexgram Holdings Berhad?

Although Nexgram Holdings Berhad had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of RM21m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We think its revenue growth of 82% is a good sign. There's no doubt fast top line growth can cure all manner of ills, for a stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Nexgram Holdings Berhad you should be aware of, and 2 of them make us uncomfortable.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Nexgram Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NEXGRAM

Nexgram Holdings Berhad

An investment holding company, provides information technology services in Malaysia and Indonesia.

Adequate balance sheet slight.

Market Insights

Community Narratives