NEXG Berhad (KLSE:NEXG) Shares Fly 31% But Investors Aren't Buying For Growth

Despite an already strong run, NEXG Berhad (KLSE:NEXG) shares have been powering on, with a gain of 31% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 8.9% isn't as impressive.

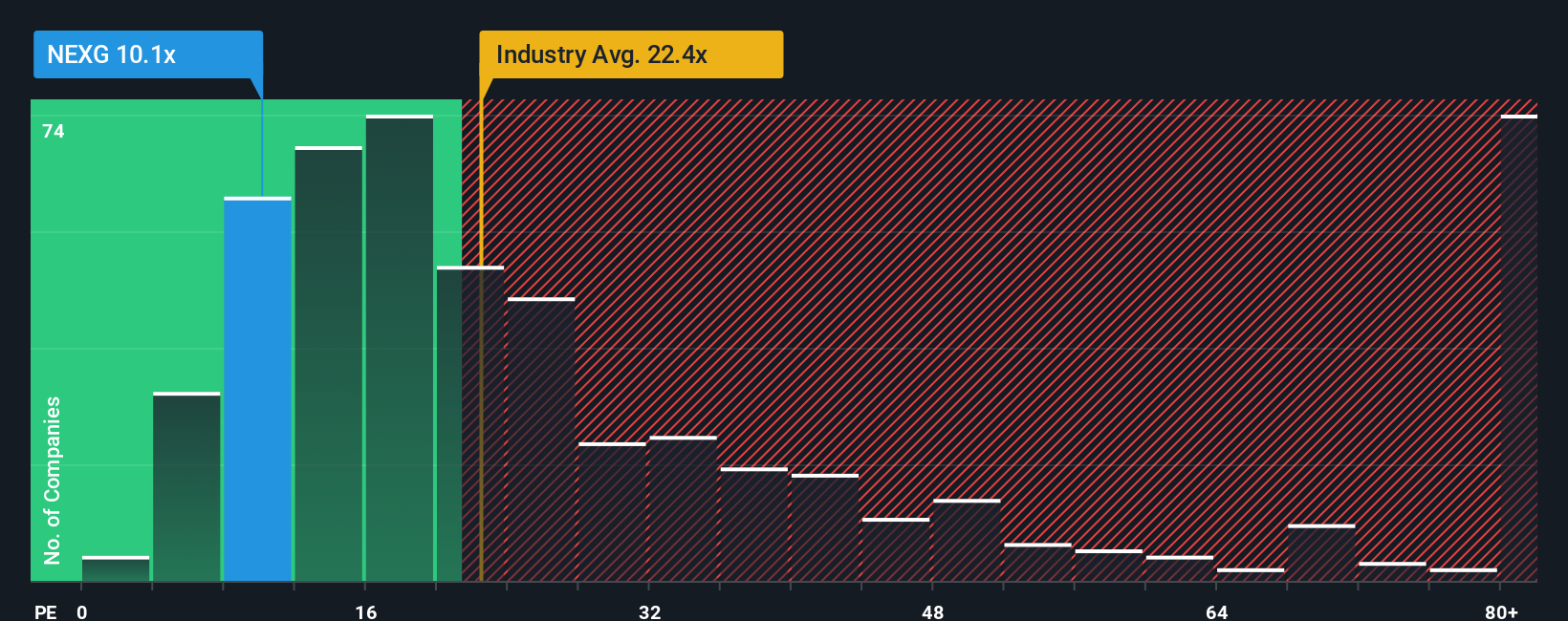

In spite of the firm bounce in price, NEXG Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.1x, since almost half of all companies in Malaysia have P/E ratios greater than 15x and even P/E's higher than 25x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, NEXG Berhad has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for NEXG Berhad

Does Growth Match The Low P/E?

In order to justify its P/E ratio, NEXG Berhad would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. Pleasingly, EPS has also lifted 398% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 9.8% per annum during the coming three years according to the two analysts following the company. That's not great when the rest of the market is expected to grow by 12% per year.

With this information, we are not surprised that NEXG Berhad is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Despite NEXG Berhad's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that NEXG Berhad maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with NEXG Berhad, and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than NEXG Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NEXG Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NEXG

NEXG Berhad

An investment holding company, provides security-based information and communication technology (ICT) solutions primarily in Malaysia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives