Getting In Cheap On N2N Connect Berhad (KLSE:N2N) Is Unlikely

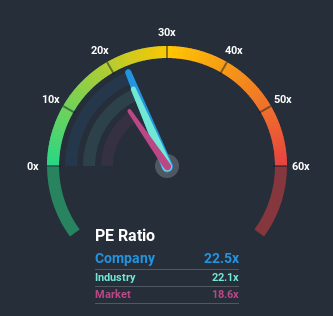

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 18x, you may consider N2N Connect Berhad (KLSE:N2N) as a stock to potentially avoid with its 22.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

N2N Connect Berhad certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for N2N Connect Berhad

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as N2N Connect Berhad's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 23% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 19% each year growth forecast for the broader market.

With this information, we find it concerning that N2N Connect Berhad is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On N2N Connect Berhad's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that N2N Connect Berhad currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware N2N Connect Berhad is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of N2N Connect Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade N2N Connect Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if N2N Connect Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:N2N

N2N Connect Berhad

An investment holding company, engages in the research and development of software packages in Malaysia, Hong Kong, China, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives