The Kronologi Asia Berhad (KLSE:KRONO) Share Price Is Up 300% And Shareholders Are Boasting About It

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term Kronologi Asia Berhad (KLSE:KRONO) shareholders would be well aware of this, since the stock is up 300% in five years. It's also good to see the share price up 24% over the last quarter.

Check out our latest analysis for Kronologi Asia Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Kronologi Asia Berhad actually saw its EPS drop 4.2% per year.

So it's hard to argue that the earnings per share are the best metric to judge the company, as it may not be optimized for profits at this point. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

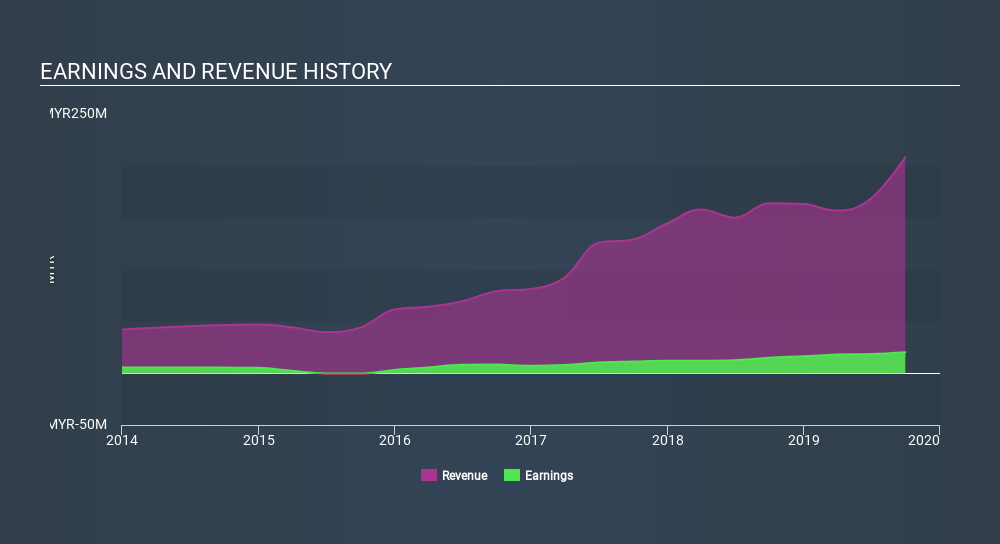

In contrast revenue growth of 32% per year is probably viewed as evidence that Kronologi Asia Berhad is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Kronologi Asia Berhad stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Kronologi Asia Berhad the TSR over the last 5 years was 315%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Kronologi Asia Berhad shareholders have received a total shareholder return of 45% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 33%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Kronologi Asia Berhad better, we need to consider many other factors. For instance, we've identified 3 warning signs for Kronologi Asia Berhad that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:KRONO

Kronologi Asia Berhad

An investment holding company, provides enterprise data management infrastructure technology, and cloud and hybrid as-a-service solutions in Singapore, China, the Philippines, India, Hong Kong, Taiwan, Malaysia, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives