Kronologi Asia Berhad's (KLSE:KRONO) Earnings Are Weaker Than They Seem

Kronologi Asia Berhad's (KLSE:KRONO) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for Kronologi Asia Berhad

A Closer Look At Kronologi Asia Berhad's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

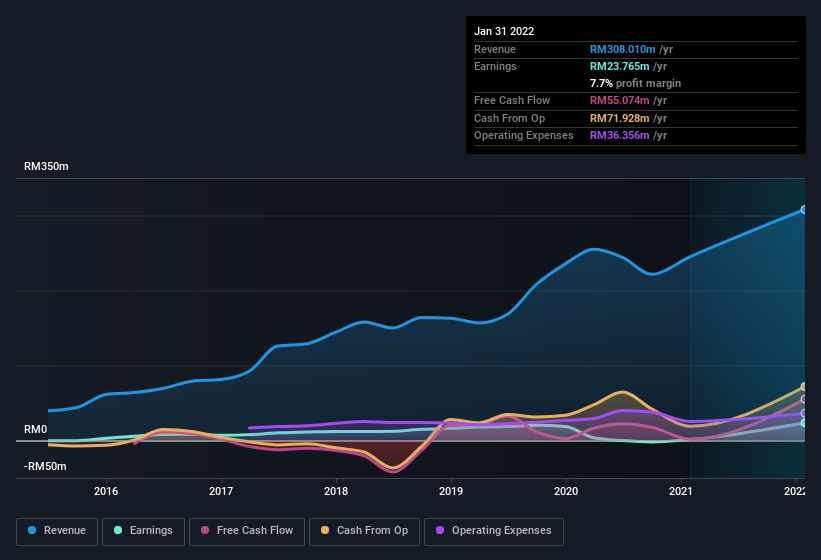

For the year to January 2022, Kronologi Asia Berhad had an accrual ratio of -0.13. That indicates that its free cash flow was a fair bit more than its statutory profit. Indeed, in the last twelve months it reported free cash flow of RM55m, well over the RM23.8m it reported in profit. Kronologi Asia Berhad shareholders are no doubt pleased that free cash flow improved over the last twelve months. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kronologi Asia Berhad.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Kronologi Asia Berhad issued 27% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Kronologi Asia Berhad's historical EPS growth by clicking on this link.

How Is Dilution Impacting Kronologi Asia Berhad's Earnings Per Share? (EPS)

As you can see above, Kronologi Asia Berhad has been growing its net income over the last few years, with an annualized gain of 41% over three years. But on the other hand, earnings per share actually fell by 17% per year. And the 1,713% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 1,410% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So Kronologi Asia Berhad shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Kronologi Asia Berhad's Profit Performance

At the end of the day, Kronologi Asia Berhad is diluting shareholders which will dampen earnings per share growth, but its accrual ratio showed it can back up its profits with free cash flow. Given the contrasting considerations, we don't have a strong view as to whether Kronologi Asia Berhad's profits are an apt reflection of its underlying potential for profit. If you want to do dive deeper into Kronologi Asia Berhad, you'd also look into what risks it is currently facing. Case in point: We've spotted 3 warning signs for Kronologi Asia Berhad you should be mindful of and 1 of these is a bit unpleasant.

Our examination of Kronologi Asia Berhad has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Kronologi Asia Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KRONO

Kronologi Asia Berhad

An investment holding company, provides cloud and hybrid as-a-service, and enterprise data management infrastructure technology (EDM IT) solutions in Malaysia, Singapore, China, the Philippines, India, Hong Kong, Taiwan, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives