- Malaysia

- /

- Semiconductors

- /

- KLSE:DNEX

If EPS Growth Is Important To You, Dagang NeXchange Berhad (KLSE:DNEX) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Dagang NeXchange Berhad (KLSE:DNEX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Dagang NeXchange Berhad

How Fast Is Dagang NeXchange Berhad Growing Its Earnings Per Share?

Dagang NeXchange Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Dagang NeXchange Berhad boosted its trailing twelve month EPS from RM0.076 to RM0.094, in the last year. That's a 25% gain; respectable growth in the broader scheme of things.

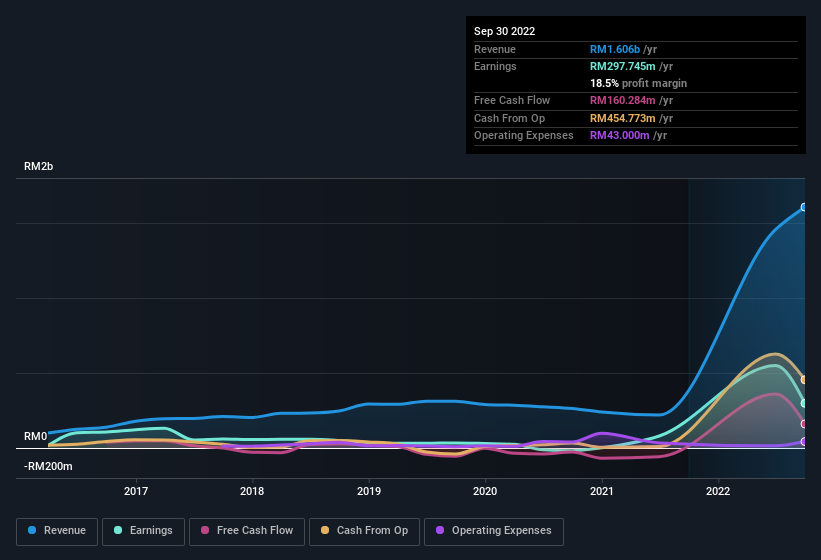

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Dagang NeXchange Berhad is growing revenues, and EBIT margins improved by 16.4 percentage points to 27%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Dagang NeXchange Berhad's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Dagang NeXchange Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Dagang NeXchange Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Holding RM287m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. Amounting to 16% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Should You Add Dagang NeXchange Berhad To Your Watchlist?

One positive for Dagang NeXchange Berhad is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. What about risks? Every company has them, and we've spotted 2 warning signs for Dagang NeXchange Berhad you should know about.

Although Dagang NeXchange Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:DNEX

Dagang NeXchange Berhad

An investment holding company, engages in information technology (IT) and eServices, and energy businesses in Asia, Europe, and North America.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives