We Think That There Are Some Issues For Cloudpoint Technology Berhad (KLSE:CLOUDPT) Beyond Its Promising Earnings

Cloudpoint Technology Berhad's (KLSE:CLOUDPT) robust recent earnings didn't do much to move the stock. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

See our latest analysis for Cloudpoint Technology Berhad

Zooming In On Cloudpoint Technology Berhad's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

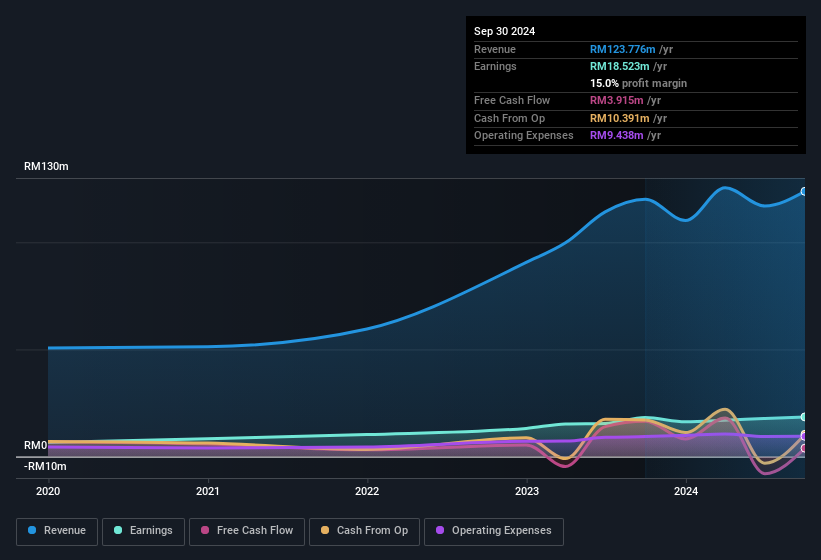

For the year to September 2024, Cloudpoint Technology Berhad had an accrual ratio of 0.60. That means it didn't generate anywhere near enough free cash flow to match its profit. Statistically speaking, that's a real negative for future earnings. Indeed, in the last twelve months it reported free cash flow of RM3.9m, which is significantly less than its profit of RM18.5m. Cloudpoint Technology Berhad's free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Cloudpoint Technology Berhad.

Our Take On Cloudpoint Technology Berhad's Profit Performance

As we discussed above, we think Cloudpoint Technology Berhad's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Cloudpoint Technology Berhad's underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 2 warning signs for Cloudpoint Technology Berhad (1 is a bit concerning!) and we strongly recommend you look at these bad boys before investing.

This note has only looked at a single factor that sheds light on the nature of Cloudpoint Technology Berhad's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CLOUDPT

Cloudpoint Technology Berhad

An investment holding company, provides information technology (IT) and artificial intelligence (AI) solutions, digital applications, and cloud services in Malaysia.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.