- Malaysia

- /

- Semiconductors

- /

- KLSE:VITROX

Subdued Growth No Barrier To ViTrox Corporation Berhad (KLSE:VITROX) With Shares Advancing 26%

ViTrox Corporation Berhad (KLSE:VITROX) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

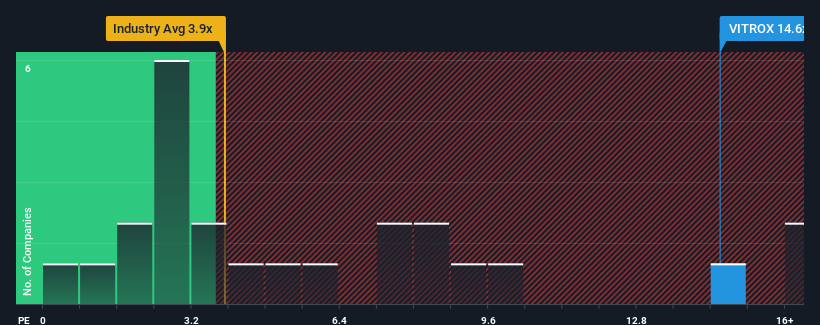

After such a large jump in price, you could be forgiven for thinking ViTrox Corporation Berhad is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.6x, considering almost half the companies in Malaysia's Semiconductor industry have P/S ratios below 3.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for ViTrox Corporation Berhad

How ViTrox Corporation Berhad Has Been Performing

ViTrox Corporation Berhad hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ViTrox Corporation Berhad.Is There Enough Revenue Growth Forecasted For ViTrox Corporation Berhad?

The only time you'd be truly comfortable seeing a P/S as steep as ViTrox Corporation Berhad's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 25% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 23% per annum, which is not materially different.

With this in consideration, we find it intriguing that ViTrox Corporation Berhad's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On ViTrox Corporation Berhad's P/S

The strong share price surge has lead to ViTrox Corporation Berhad's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given ViTrox Corporation Berhad's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for ViTrox Corporation Berhad (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of ViTrox Corporation Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VITROX

ViTrox Corporation Berhad

An investment holding company, designs, manufactures, and sells automated vision inspection equipment and system-on-chip embedded electronics devices for the semiconductor and electronics packaging industries worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026