- Malaysia

- /

- Semiconductors

- /

- KLSE:KESM

Downgrade: Here's How Analysts See KESM Industries Berhad (KLSE:KESM) Performing In The Near Term

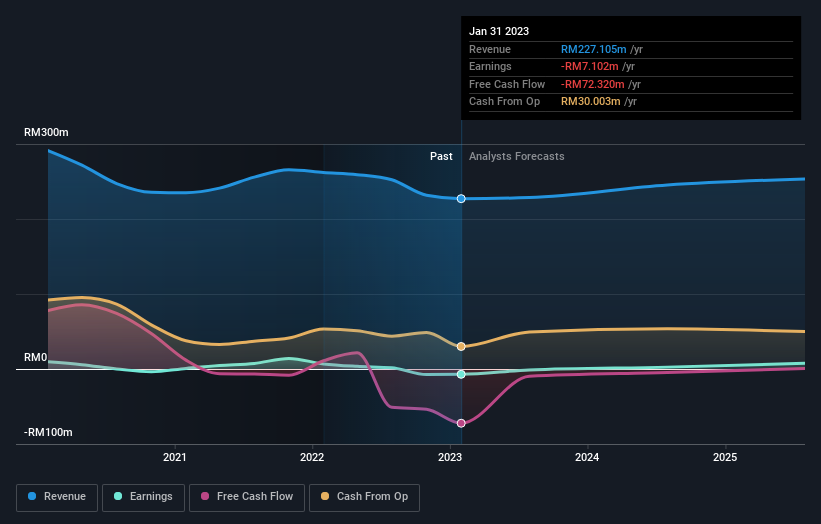

Market forces rained on the parade of KESM Industries Berhad (KLSE:KESM) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following this downgrade, KESM Industries Berhad's three analysts are forecasting 2023 revenues to be RM229m, approximately in line with the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 83% to RM0.029. Before this latest update, the analysts had been forecasting revenues of RM254m and earnings per share (EPS) of RM0.045 in 2023. There looks to have been a major change in sentiment regarding KESM Industries Berhad's prospects, with a measurable cut to revenues and the analysts now forecasting a loss instead of a profit.

View our latest analysis for KESM Industries Berhad

The consensus price target lifted 7.3% to RM7.28, clearly signalling that the weaker revenue and EPS outlook are not expected to weigh on the stock over the longer term. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values KESM Industries Berhad at RM8.26 per share, while the most bearish prices it at RM6.58. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the KESM Industries Berhad's past performance and to peers in the same industry. From these estimates it looks as though the analysts expect the years of declining sales to come to an end, given the flat revenue forecast out to 2023. That would be a definite improvement, given that the past five years have seen sales shrink 9.6% annually. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 13% annually. Although KESM Industries Berhad's revenues are expected to improve, it seems that it is still expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that analysts are expecting KESM Industries Berhad to become unprofitable this year. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that KESM Industries Berhad's revenues are expected to grow slower than the wider market. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple KESM Industries Berhad analysts - going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if KESM Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KESM

KESM Industries Berhad

An investment holding company, provides burn-in and test services to semiconductor manufacturers in Malaysia, the People’s Republic of China, Singapore, the United States, and Europe.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.