- Malaysia

- /

- Semiconductors

- /

- KLSE:INARI

Inari Amertron Berhad's (KLSE:INARI) earnings have declined over year, contributing to shareholders 43% loss

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Inari Amertron Berhad (KLSE:INARI) share price slid 44% over twelve months. That contrasts poorly with the market decline of 6.0%. However, the longer term returns haven't been so bad, with the stock down 28% in the last three years.

While the stock has risen 3.9% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

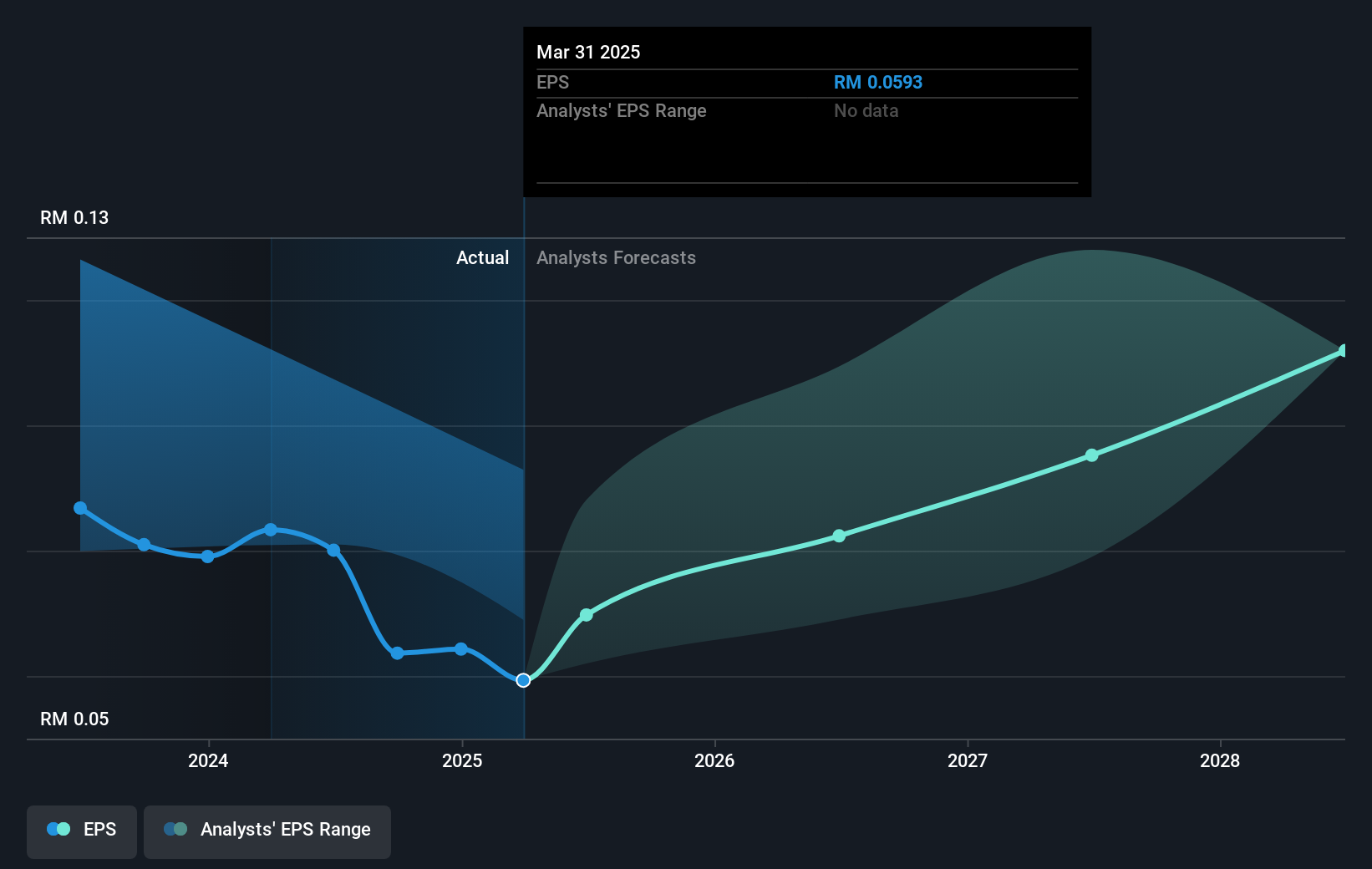

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Inari Amertron Berhad had to report a 29% decline in EPS over the last year. The share price decline of 44% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Inari Amertron Berhad's key metrics by checking this interactive graph of Inari Amertron Berhad's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, Inari Amertron Berhad shareholders did even worse, losing 43% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 0.8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Inari Amertron Berhad better, we need to consider many other factors. For instance, we've identified 1 warning sign for Inari Amertron Berhad that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:INARI

Inari Amertron Berhad

Engages in the provision of electronic manufacturing, outsourced semiconductor assembly, and testing services for radio frequency, fiber-optics transceivers, optoelectronics, memory modules, sensors, and custom integrated circuit (IC) technologies.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives