Kem Chin has been the CEO of Genetec Technology Berhad (KLSE:GENETEC) since 1997, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Genetec Technology Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Genetec Technology Berhad

Comparing Genetec Technology Berhad's CEO Compensation With the industry

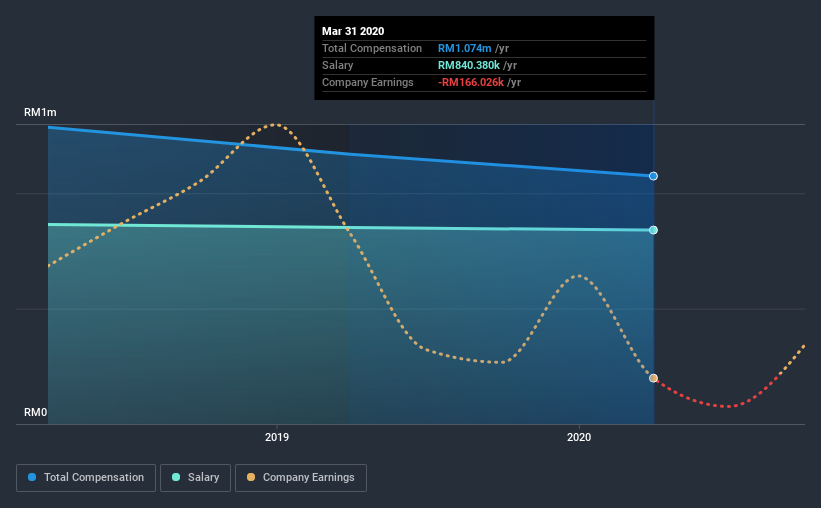

According to our data, Genetec Technology Berhad has a market capitalization of RM84m, and paid its CEO total annual compensation worth RM1.1m over the year to March 2020. That's a notable decrease of 8.1% on last year. We note that the salary portion, which stands at RM840.4k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below RM809m, we found that the median total CEO compensation was RM745k. Accordingly, our analysis reveals that Genetec Technology Berhad pays Kem Chin north of the industry median. What's more, Kem Chin holds RM7.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM840k | RM851k | 78% |

| Other | RM234k | RM318k | 22% |

| Total Compensation | RM1.1m | RM1.2m | 100% |

Speaking on an industry level, nearly 87% of total compensation represents salary, while the remainder of 13% is other remuneration. Although there is a difference in how total compensation is set, Genetec Technology Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Genetec Technology Berhad's Growth Numbers

Over the last three years, Genetec Technology Berhad has shrunk its earnings per share by 26% per year. It achieved revenue growth of 23% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Genetec Technology Berhad Been A Good Investment?

We think that the total shareholder return of 69%, over three years, would leave most Genetec Technology Berhad shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As previously discussed, Kem is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Still, shareholder returns over the last three years,and recent revenue growth have been trending northwards. Sadly, EPS growth did not follow suit, remaining during this time. Although we would have liked to see EPS growth, positive shareholder returns, and growing revenues make us believe CEO compensation is reasonable.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Genetec Technology Berhad (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Genetec Technology Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:GENETEC

Genetec Technology Berhad

An investment holding company, designs, manufactures, and sells smart automation systems, customized factory automated equipment, and integrated systems in the United States, Europe, the Middle East, Malaysia, Thailand, Mexico, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026