- Taiwan

- /

- Renewable Energy

- /

- TWSE:6869

3 Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a period of recovery and anticipation, growth stocks have notably outperformed value shares, driven by strong performances in the technology sector. With the Federal Reserve's potential rate cuts on the horizon and inflation data showing mixed signals, investors are increasingly looking for companies that not only show robust growth potential but also have high insider ownership—a key indicator of management's confidence in their own business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Let's uncover some gems from our specialized screener.

D & O Green Technologies Berhad (KLSE:D&O)

Simply Wall St Growth Rating: ★★★★☆☆

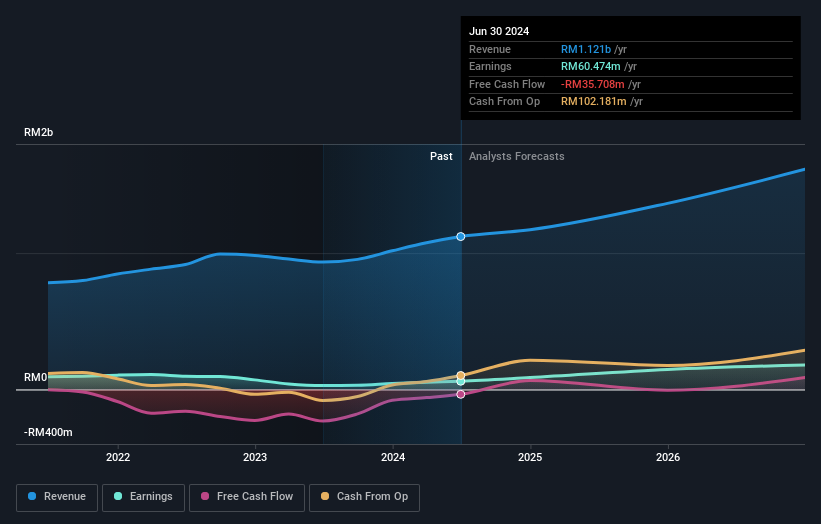

Overview: D & O Green Technologies Berhad, with a market cap of MYR3.48 billion, manufactures and sells automotive surface mount technology light-emitting diodes through its subsidiary Dominant Opto Technologies Sdn Bhd in Asia, Europe, the United States, and internationally.

Operations: The company generated MYR1.12 billion in revenue from the semiconductor industry.

Insider Ownership: 19.2%

Revenue Growth Forecast: 15% p.a.

D & O Green Technologies Berhad has shown strong growth, with earnings for the second quarter rising to MYR 7.76 million from MYR 0.716 million a year ago, and six-month sales reaching MYR 539.37 million. Earnings are expected to grow significantly at an annual rate of 42.5% over the next three years, outpacing market averages. Despite lower forecasted Return on Equity (13.4%), analysts agree that the stock price could rise by 75.2%.

- Delve into the full analysis future growth report here for a deeper understanding of D & O Green Technologies Berhad.

- Our comprehensive valuation report raises the possibility that D & O Green Technologies Berhad is priced higher than what may be justified by its financials.

Kossan Rubber Industries Bhd (KLSE:KOSSAN)

Simply Wall St Growth Rating: ★★★★☆☆

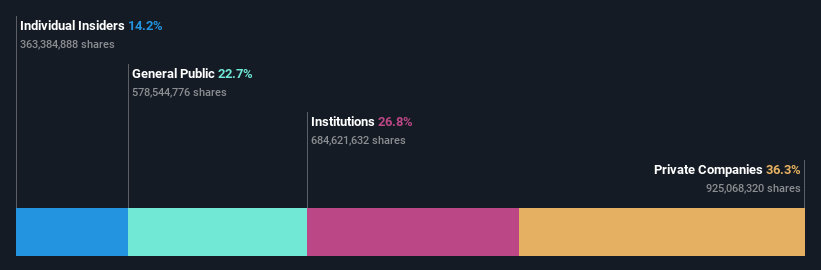

Overview: Kossan Rubber Industries Bhd, an investment holding company with a market cap of MYR5.74 billion, manufactures and sells latex disposable gloves in Malaysia and internationally.

Operations: The company generates revenue from three main segments: MYR1.39 billion from Gloves, MYR105.22 million from Clean-Room, and MYR199.49 million from Technical Rubber.

Insider Ownership: 14.2%

Revenue Growth Forecast: 16.2% p.a.

Kossan Rubber Industries Bhd has demonstrated promising growth, with second-quarter sales rising to MYR 429.91 million and net income reaching MYR 31.34 million compared to a loss last year. Earnings are forecasted to grow at 28% annually, significantly outpacing the market's average of 10.6%. However, the company's Return on Equity is expected to be low at 5.1% in three years, and its dividend yield of 1.89% is not well covered by earnings or free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Kossan Rubber Industries Bhd.

- Upon reviewing our latest valuation report, Kossan Rubber Industries Bhd's share price might be too optimistic.

J&V Energy Technology (TWSE:6869)

Simply Wall St Growth Rating: ★★★★★☆

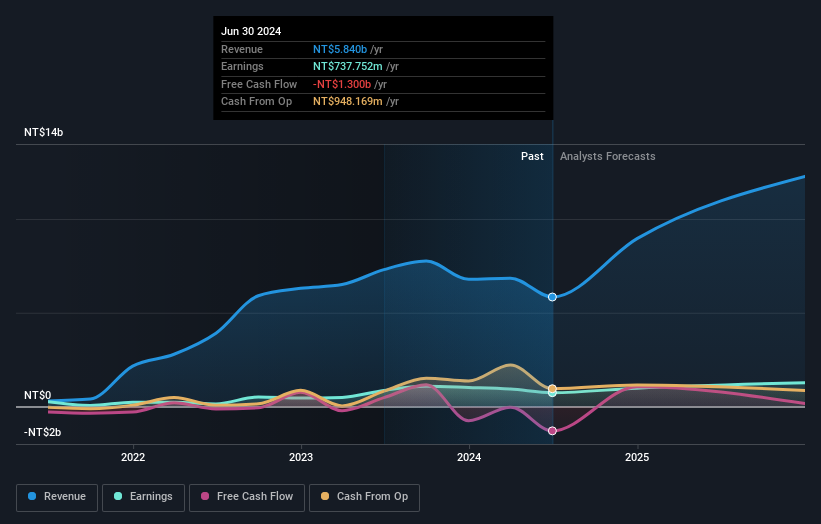

Overview: J&V Energy Technology Co., Ltd., along with its subsidiaries, focuses on the development, investment, maintenance, and management of renewable energy plants in Taiwan and has a market cap of NT$27.01 billion.

Operations: J&V Energy Technology's revenue segments include NT$3.12 billion from Energy Storage Engineering, NT$786.77 million from Solar Engineering, NT$751.61 million from the Sale of Electricity, and NT$201.58 million from Trading of Energy Equipment.

Insider Ownership: 30.2%

Revenue Growth Forecast: 46.7% p.a.

J&V Energy Technology's earnings are forecast to grow 35.25% annually, significantly outpacing the TW market average of 18.4%. Despite this, recent financial results show a decline in sales and net income for Q2 and the first half of 2024 compared to last year. The stock has experienced high volatility over the past three months, and shareholders have faced dilution in the past year. Additionally, its dividend yield of 2.37% is not well covered by free cash flows.

- Get an in-depth perspective on J&V Energy Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that J&V Energy Technology is trading beyond its estimated value.

Next Steps

- Navigate through the entire inventory of 1492 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6869

J&V Energy Technology

Engages in the development, investment, maintenance, and management of renewable energy plants in Taiwan.

High growth potential with adequate balance sheet.