- Malaysia

- /

- General Merchandise and Department Stores

- /

- KLSE:PARKSON

Parkson Holdings Berhad (KLSE:PARKSON) shareholder returns have been splendid, earning 105% in 5 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Parkson Holdings Berhad (KLSE:PARKSON) shareholders would be well aware of this, since the stock is up 105% in five years. And in the last month, the share price has gained 22%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

Since it's been a strong week for Parkson Holdings Berhad shareholders, let's have a look at trend of the longer term fundamentals.

Our free stock report includes 1 warning sign investors should be aware of before investing in Parkson Holdings Berhad. Read for free now.Given that Parkson Holdings Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Parkson Holdings Berhad saw its revenue shrink by 3.3% per year. Given that scenario, we wouldn't have expected the share price to rise 15% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

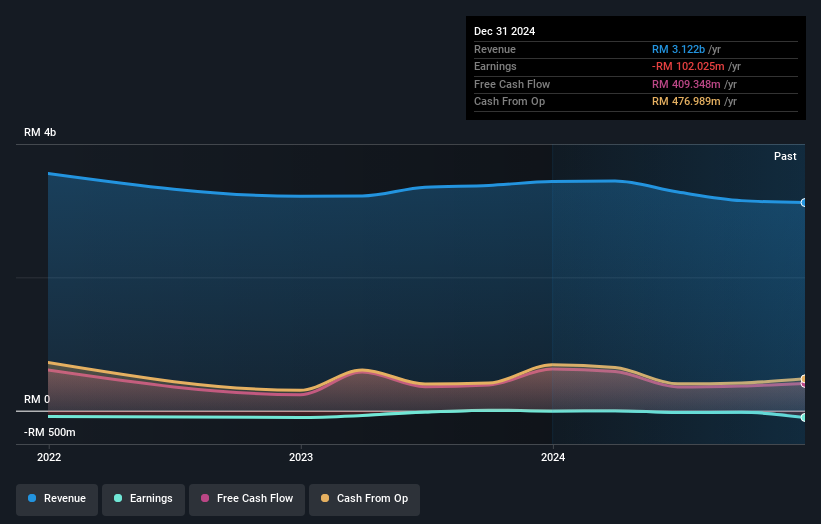

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Parkson Holdings Berhad shareholders are down 26% for the year. Unfortunately, that's worse than the broader market decline of 2.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Parkson Holdings Berhad better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Parkson Holdings Berhad you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PARKSON

Parkson Holdings Berhad

An investment holding company, engages in the operation and management of department stores under the Parkson brand in Malaysia and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives