- Malaysia

- /

- Specialty Stores

- /

- KLSE:LOTUSCIR

If EPS Growth Is Important To You, MESB Berhad (KLSE:MESB) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MESB Berhad (KLSE:MESB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for MESB Berhad

How Fast Is MESB Berhad Growing Its Earnings Per Share?

In the last three years MESB Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, MESB Berhad's EPS soared from RM0.061 to RM0.096, over the last year. That's a commendable gain of 56%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. MESB Berhad's EBIT margins have actually improved by 6.9 percentage points in the last year, to reach 12%, but, on the flip side, revenue was down 20%. While not disastrous, these figures could be better.

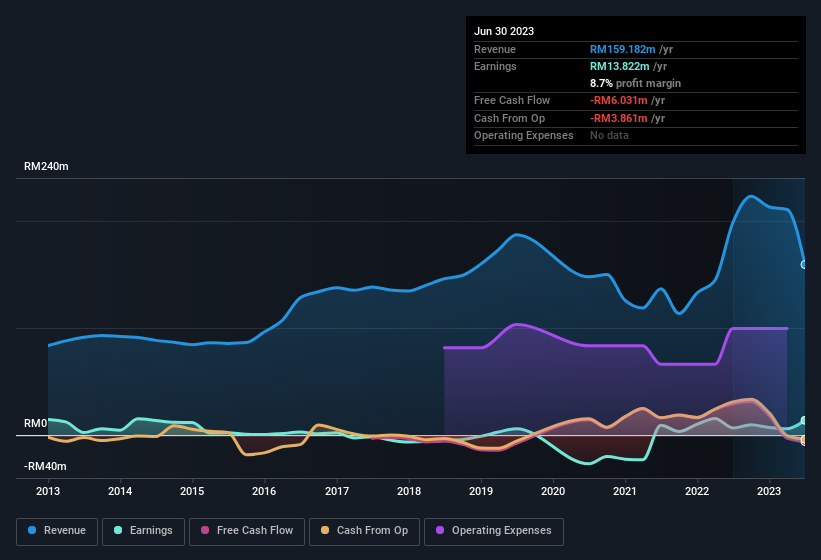

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

MESB Berhad isn't a huge company, given its market capitalisation of RM74m. That makes it extra important to check on its balance sheet strength.

Are MESB Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that MESB Berhad insiders own a meaningful share of the business. To be exact, company insiders hold 51% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, MESB Berhad is a very small company, with a market cap of only RM74m. That means insiders only have RM37m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like MESB Berhad with market caps under RM943m is about RM520k.

The CEO of MESB Berhad was paid just RM22k in total compensation for the year ending June 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does MESB Berhad Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into MESB Berhad's strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that MESB Berhad has underlying strengths that make it worth a look at. We don't want to rain on the parade too much, but we did also find 3 warning signs for MESB Berhad (1 can't be ignored!) that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LOTUSCIR

Lotus Circular Berhad

An investment holding company, engages in trading and retailing of leather products and apparel in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives