- Malaysia

- /

- Real Estate

- /

- KLSE:LBICAP

Do Investors Have Good Reason To Be Wary Of LBI Capital Berhad's (KLSE:LBICAP) 4.4% Dividend Yield?

Dividend paying stocks like LBI Capital Berhad (KLSE:LBICAP) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

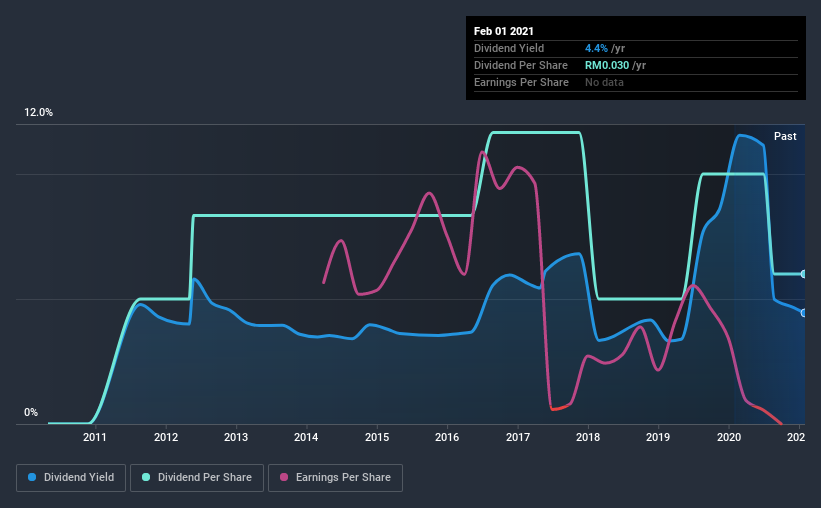

With a nine-year payment history and a 4.4% yield, many investors probably find LBI Capital Berhad intriguing. It sure looks interesting on these metrics - but there's always more to the story. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. While LBI Capital Berhad pays a dividend, it reported a loss over the last year. When a company recently reported a loss, we should investigate if its cash flows covered the dividend.

LBI Capital Berhad paid out 146% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term.

With a strong net cash balance, LBI Capital Berhad investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on LBI Capital Berhad's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that LBI Capital Berhad paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was RM0.03 in 2012, compared to RM0.03 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.0% a year over that time. LBI Capital Berhad's dividend payments have fluctuated, so it hasn't grown 2.0% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. LBI Capital Berhad's earnings per share have shrunk at 40% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

We'd also point out that LBI Capital Berhad issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. LBI Capital Berhad's dividend is not well covered by free cash flow, plus it paid a dividend while being unprofitable. Earnings per share are down, and LBI Capital Berhad's dividend has been cut at least once in the past, which is disappointing. In this analysis, LBI Capital Berhad doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, LBI Capital Berhad has 4 warning signs (and 1 which is concerning) we think you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade LBI Capital Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LBICAP

LBI Capital Berhad

An investment holding company, engages in the development of residential and commercial properties in Malaysia.

Excellent balance sheet moderate and pays a dividend.