- Malaysia

- /

- Real Estate

- /

- KLSE:IWCITY

Would Shareholders Who Purchased Iskandar Waterfront City Berhad's (KLSE:IWCITY) Stock Three Years Be Happy With The Share price Today?

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Iskandar Waterfront City Berhad (KLSE:IWCITY) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 67% drop in the share price over that period. The more recent news is of little comfort, with the share price down 38% in a year. More recently, the share price has dropped a further 22% in a month.

See our latest analysis for Iskandar Waterfront City Berhad

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Iskandar Waterfront City Berhad moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

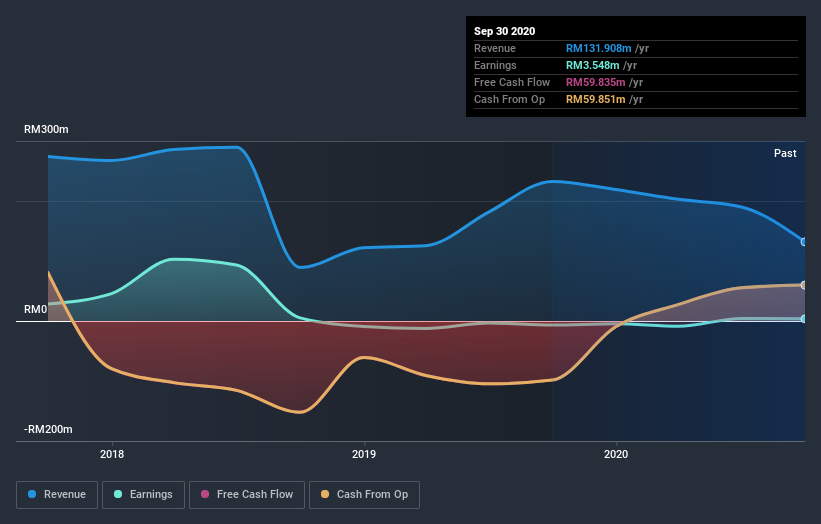

We think that the revenue decline over three years, at a rate of 16% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Iskandar Waterfront City Berhad's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 7.1% in the last year, Iskandar Waterfront City Berhad shareholders lost 38%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Iskandar Waterfront City Berhad that you should be aware of before investing here.

But note: Iskandar Waterfront City Berhad may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you’re looking to trade Iskandar Waterfront City Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:IWCITY

Iskandar Waterfront City Berhad

An investment holding company, engages in the property development and construction business in Malaysia.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives