- Malaysia

- /

- Real Estate

- /

- KLSE:ENCORP

These 4 Measures Indicate That Encorp Berhad (KLSE:ENCORP) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Encorp Berhad (KLSE:ENCORP) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Encorp Berhad

What Is Encorp Berhad's Debt?

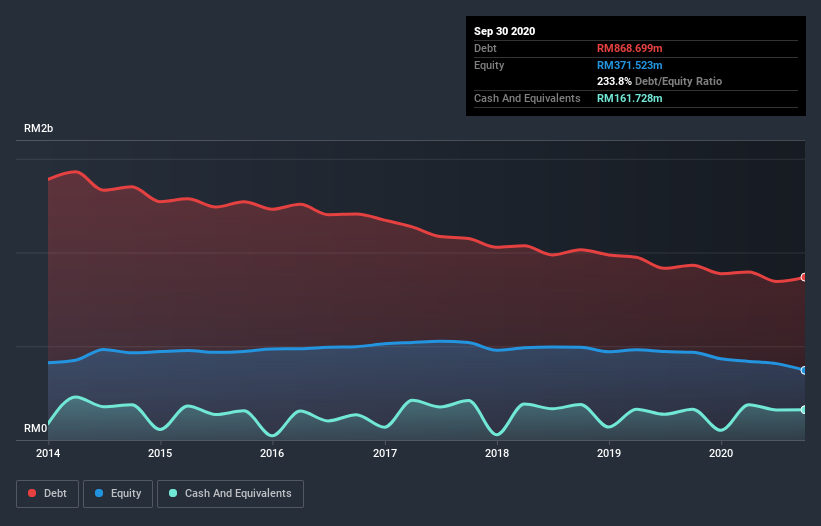

The image below, which you can click on for greater detail, shows that Encorp Berhad had debt of RM868.7m at the end of September 2020, a reduction from RM932.0m over a year. However, because it has a cash reserve of RM161.7m, its net debt is less, at about RM707.0m.

How Strong Is Encorp Berhad's Balance Sheet?

We can see from the most recent balance sheet that Encorp Berhad had liabilities of RM486.3m falling due within a year, and liabilities of RM1.08b due beyond that. Offsetting this, it had RM161.7m in cash and RM145.4m in receivables that were due within 12 months. So it has liabilities totalling RM1.26b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM69.6m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Encorp Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Encorp Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (13.0), and fairly weak interest coverage, since EBIT is just 0.40 times the interest expense. The debt burden here is substantial. Worse, Encorp Berhad's EBIT was down 24% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Encorp Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Encorp Berhad actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Encorp Berhad's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. After considering the datapoints discussed, we think Encorp Berhad has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Encorp Berhad (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Encorp Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Encorp Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ENCORP

Encorp Berhad

An investment holding company, provides general management support services in Malaysia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion