- Malaysia

- /

- Real Estate

- /

- KLSE:CRESNDO

A Quick Analysis On Crescendo Corporation Berhad's (KLSE:CRESNDO) CEO Salary

The CEO of Crescendo Corporation Berhad (KLSE:CRESNDO) is Seong Gooi, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Crescendo Corporation Berhad.

View our latest analysis for Crescendo Corporation Berhad

Comparing Crescendo Corporation Berhad's CEO Compensation With the industry

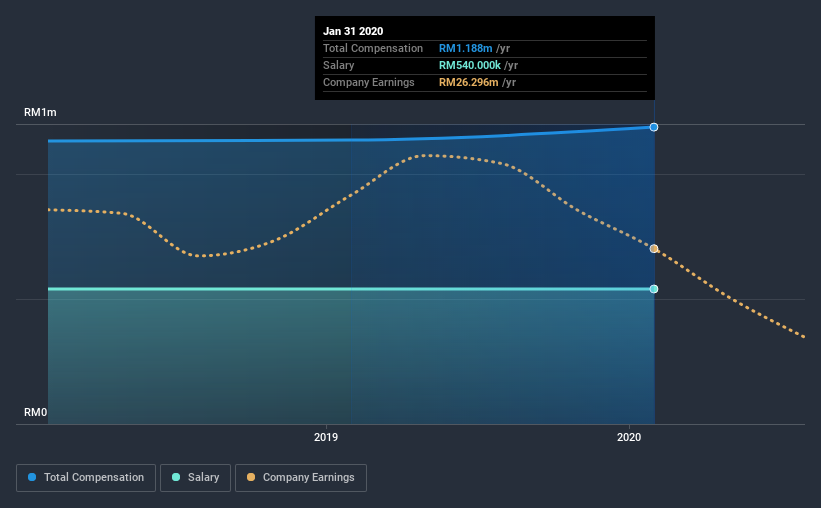

According to our data, Crescendo Corporation Berhad has a market capitalization of RM299m, and paid its CEO total annual compensation worth RM1.2m over the year to January 2020. That's a modest increase of 4.6% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at RM540k.

For comparison, other companies in the industry with market capitalizations below RM813m, reported a median total CEO compensation of RM802k. Hence, we can conclude that Seong Gooi is remunerated higher than the industry median. Moreover, Seong Gooi also holds RM1.3m worth of Crescendo Corporation Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM540k | RM540k | 45% |

| Other | RM648k | RM596k | 55% |

| Total Compensation | RM1.2m | RM1.1m | 100% |

Speaking on an industry level, nearly 80% of total compensation represents salary, while the remainder of 20% is other remuneration. In Crescendo Corporation Berhad's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Crescendo Corporation Berhad's Growth

Crescendo Corporation Berhad has reduced its earnings per share by 32% a year over the last three years. Its revenue is down 21% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Crescendo Corporation Berhad Been A Good Investment?

With a three year total loss of 18% for the shareholders, Crescendo Corporation Berhad would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, Seong is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. This doesn't look good against shareholder returns, which have been negative for the past three years. What's equally worrying is that the company isn't growing by our analysis. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 1 which is significant) in Crescendo Corporation Berhad we think you should know about.

Important note: Crescendo Corporation Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Crescendo Corporation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CRESNDO

Crescendo Corporation Berhad

An investment holding company, invests in, develops, constructs, and manages properties in Malaysia.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026