Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in OSK Holdings Berhad (KLSE:OSK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide OSK Holdings Berhad with the means to add long-term value to shareholders.

View our latest analysis for OSK Holdings Berhad

How Quickly Is OSK Holdings Berhad Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, OSK Holdings Berhad has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

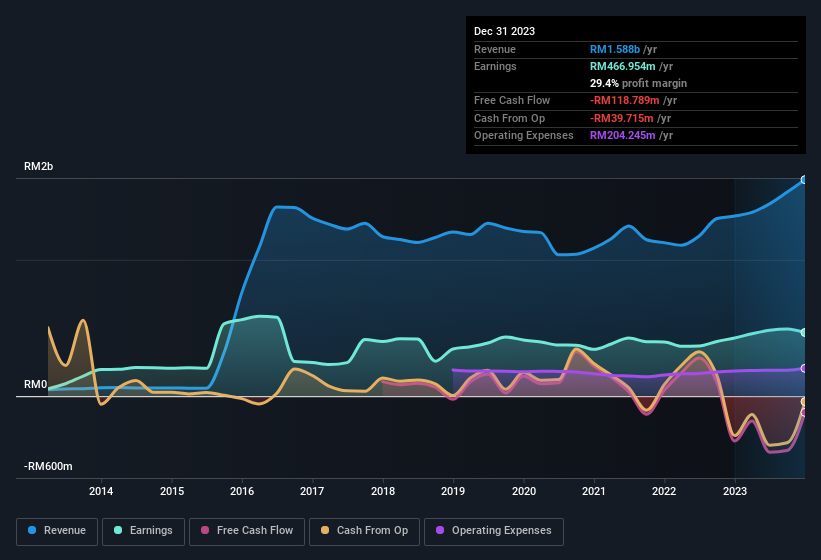

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of OSK Holdings Berhad's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for OSK Holdings Berhad remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 20% to RM1.6b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for OSK Holdings Berhad's future profits.

Are OSK Holdings Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that OSK Holdings Berhad insiders have a significant amount of capital invested in the stock. With a whopping RM386m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 13% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Should You Add OSK Holdings Berhad To Your Watchlist?

One important encouraging feature of OSK Holdings Berhad is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Before you take the next step you should know about the 2 warning signs for OSK Holdings Berhad (1 is potentially serious!) that we have uncovered.

Although OSK Holdings Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OSK

OSK Holdings Berhad

An investment holding company, operates in the property sector in Malaysia and Australia.

Solid track record and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion