- Malaysia

- /

- Real Estate

- /

- KLSE:LBS

Improved Earnings Required Before LBS Bina Group Berhad (KLSE:LBS) Stock's 26% Jump Looks Justified

LBS Bina Group Berhad (KLSE:LBS) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 119% following the latest surge, making investors sit up and take notice.

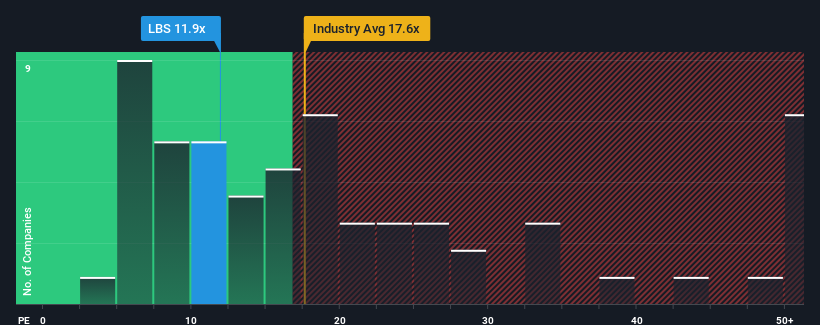

Even after such a large jump in price, LBS Bina Group Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.9x, since almost half of all companies in Malaysia have P/E ratios greater than 18x and even P/E's higher than 34x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for LBS Bina Group Berhad as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for LBS Bina Group Berhad

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as LBS Bina Group Berhad's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. The latest three year period has also seen an excellent 134% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.5% per year as estimated by the two analysts watching the company. With the market predicted to deliver 12% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that LBS Bina Group Berhad's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On LBS Bina Group Berhad's P/E

Despite LBS Bina Group Berhad's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that LBS Bina Group Berhad maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for LBS Bina Group Berhad that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LBS

LBS Bina Group Berhad

An investment holding company, primarily engages in property development business in Malaysia and Saudi Arabia.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives