- Malaysia

- /

- Real Estate

- /

- KLSE:KSL

With EPS Growth And More, KSL Holdings Berhad (KLSE:KSL) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like KSL Holdings Berhad (KLSE:KSL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for KSL Holdings Berhad

How Fast Is KSL Holdings Berhad Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that KSL Holdings Berhad's EPS has grown 25% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

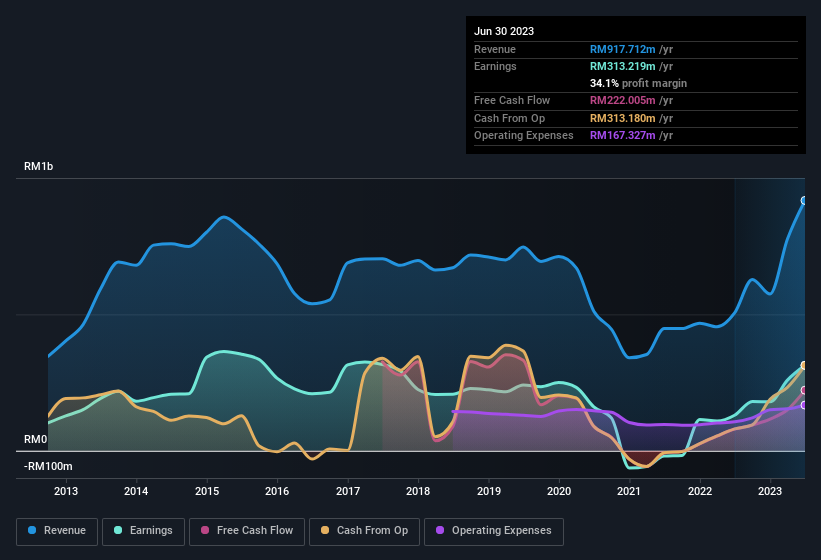

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that KSL Holdings Berhad is growing revenues, and EBIT margins improved by 6.7 percentage points to 36%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

KSL Holdings Berhad isn't a huge company, given its market capitalisation of RM1.1b. That makes it extra important to check on its balance sheet strength.

Are KSL Holdings Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own KSL Holdings Berhad shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at RM370m, they have plenty of motivation to push the business to succeed. Amounting to 34% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to KSL Holdings Berhad, with market caps between RM465m and RM1.9b, is around RM691k.

The CEO of KSL Holdings Berhad was paid just RM120k in total compensation for the year ending December 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add KSL Holdings Berhad To Your Watchlist?

You can't deny that KSL Holdings Berhad has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes KSL Holdings Berhad look rather interesting indeed. We don't want to rain on the parade too much, but we did also find 1 warning sign for KSL Holdings Berhad that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if KSL Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KSL

KSL Holdings Berhad

An investment holding company, engages in the property development business in Malaysia.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.