Media Prima Berhad's (KLSE:MEDIA) Shareholders Are Down 87% On Their Shares

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Media Prima Berhad (KLSE:MEDIA) during the five years that saw its share price drop a whopping 87%. And we doubt long term believers are the only worried holders, since the stock price has declined 55% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 13% in thirty days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Media Prima Berhad

Because Media Prima Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Media Prima Berhad saw its revenue shrink by 6.4% per year. That's not what investors generally want to see. The share price fall of 13% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

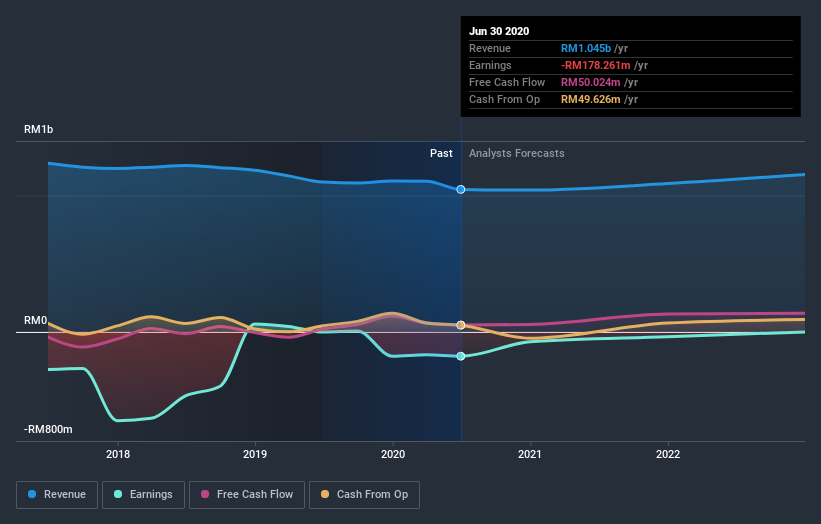

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Media Prima Berhad is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Media Prima Berhad stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 1.1% in the last year, Media Prima Berhad shareholders lost 55%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Media Prima Berhad is showing 4 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Media Prima Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:MEDIA

Media Prima Berhad

Operates as a media company in Malaysia and internationally.

Excellent balance sheet and fair value.