- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:WANGZNG

Wang-Zheng Berhad (KLSE:WANGZNG) Has A Pretty Healthy Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Wang-Zheng Berhad (KLSE:WANGZNG) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Wang-Zheng Berhad

What Is Wang-Zheng Berhad's Debt?

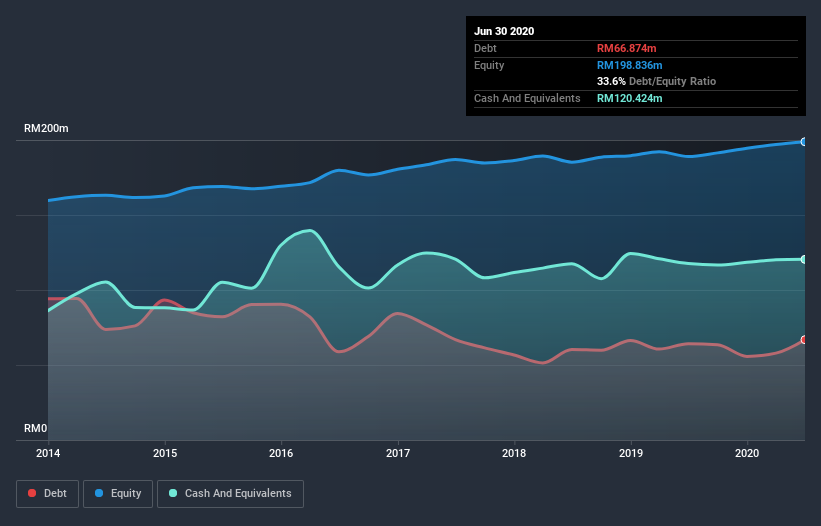

As you can see below, at the end of June 2020, Wang-Zheng Berhad had RM66.9m of debt, up from RM64.2m a year ago. Click the image for more detail. However, it does have RM120.4m in cash offsetting this, leading to net cash of RM53.6m.

How Healthy Is Wang-Zheng Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Wang-Zheng Berhad had liabilities of RM79.8m due within 12 months and liabilities of RM8.22m due beyond that. On the other hand, it had cash of RM120.4m and RM59.1m worth of receivables due within a year. So it can boast RM91.5m more liquid assets than total liabilities.

This excess liquidity is a great indication that Wang-Zheng Berhad's balance sheet is just as strong as racists are weak. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Simply put, the fact that Wang-Zheng Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

In fact Wang-Zheng Berhad's saving grace is its low debt levels, because its EBIT has tanked 22% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Wang-Zheng Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Wang-Zheng Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Wang-Zheng Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Wang-Zheng Berhad has net cash of RM53.6m, as well as more liquid assets than liabilities. So we don't have any problem with Wang-Zheng Berhad's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Wang-Zheng Berhad (of which 1 is potentially serious!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Wang-Zheng Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wang-Zheng Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:WANGZNG

Wang-Zheng Berhad

An investment holding company, engages in the manufacture, processing, and distribution of fiber-based products in Malaysia, rest of Asia, Africa, and Australia.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026