Here's Why Tomypak Holdings Berhad (KLSE:TOMYPAK) Can Afford Some Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Tomypak Holdings Berhad (KLSE:TOMYPAK) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tomypak Holdings Berhad

What Is Tomypak Holdings Berhad's Debt?

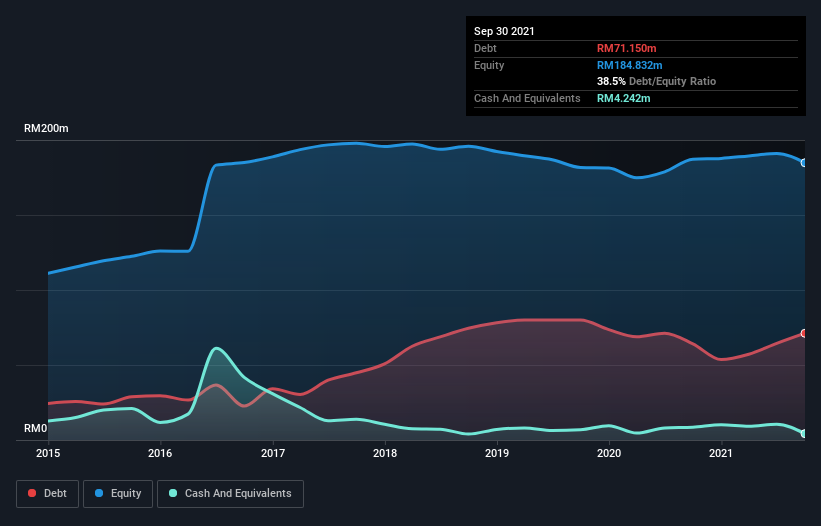

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Tomypak Holdings Berhad had RM71.2m of debt, an increase on RM64.1m, over one year. However, it does have RM4.24m in cash offsetting this, leading to net debt of about RM66.9m.

How Strong Is Tomypak Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Tomypak Holdings Berhad had liabilities of RM88.8m falling due within a year, and liabilities of RM4.60m due beyond that. Offsetting this, it had RM4.24m in cash and RM59.6m in receivables that were due within 12 months. So it has liabilities totalling RM29.5m more than its cash and near-term receivables, combined.

Since publicly traded Tomypak Holdings Berhad shares are worth a total of RM174.6m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Tomypak Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Tomypak Holdings Berhad saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Tomypak Holdings Berhad had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at RM2.1m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through RM11m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Tomypak Holdings Berhad you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tomypak Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOMYPAK

Tomypak Holdings Berhad

An investment holding company, engages in the manufacture and marketing of flexible and industrial packaging materials for food and beverage companies in Malaysia and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026