- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:TIMWELL

What Can We Make Of Timberwell Berhad's (KLSE:TIMWELL) CEO Compensation?

This article will reflect on the compensation paid to Chiong Pau who has served as CEO of Timberwell Berhad (KLSE:TIMWELL) since 2006. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Timberwell Berhad

Comparing Timberwell Berhad's CEO Compensation With the industry

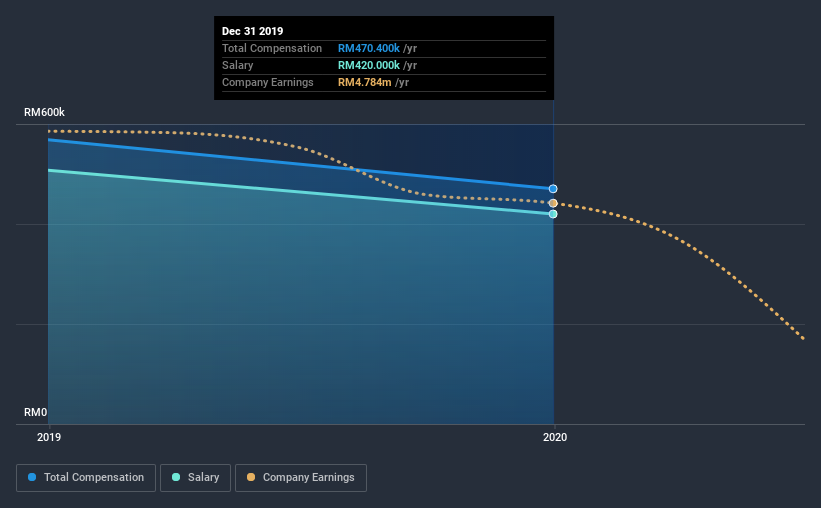

At the time of writing, our data shows that Timberwell Berhad has a market capitalization of RM37m, and reported total annual CEO compensation of RM470k for the year to December 2019. Notably, that's a decrease of 17% over the year before. Notably, the salary which is RM420.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below RM817m, we found that the median total CEO compensation was RM526k. This suggests that Timberwell Berhad remunerates its CEO largely in line with the industry average. Furthermore, Chiong Pau directly owns RM332k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM420k | RM508k | 89% |

| Other | RM50k | RM61k | 11% |

| Total Compensation | RM470k | RM568k | 100% |

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. Although there is a difference in how total compensation is set, Timberwell Berhad more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Timberwell Berhad's Growth

Over the past three years, Timberwell Berhad has seen its earnings per share (EPS) grow by 86% per year. In the last year, its revenue is down 44%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Timberwell Berhad Been A Good Investment?

Since shareholders would have lost about 33% over three years, some Timberwell Berhad investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, Timberwell Berhad pays its CEO in line with similar-sized companies belonging to the same industry. At the same time, the company has logged negative shareholder returns over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Overall, we wouldn't say Chiong is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 5 warning signs for Timberwell Berhad (2 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Timberwell Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Timberwell Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:TIMWELL

Timberwell Berhad

An investment holding company, engages in the forest management, and timber harvesting and trading businesses in Malaysia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026