Tek Seng Holdings Berhad (KLSE:TEKSENG) Shareholders Have Enjoyed An Impressive 123% Share Price Gain

Tek Seng Holdings Berhad (KLSE:TEKSENG) shareholders have seen the share price descend 15% over the month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 123% in that time. So some might not be surprised to see the price retrace some. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for Tek Seng Holdings Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Tek Seng Holdings Berhad went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 11% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

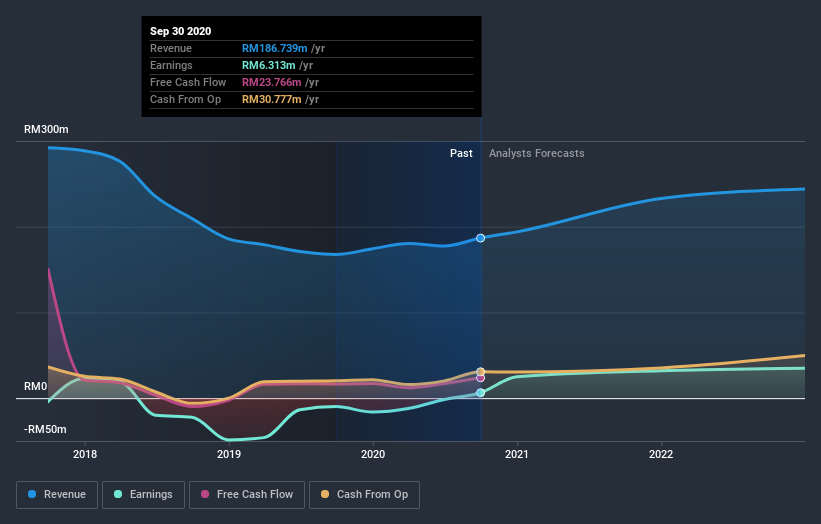

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Tek Seng Holdings Berhad has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Tek Seng Holdings Berhad in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Tek Seng Holdings Berhad shareholders have received a total shareholder return of 123% over the last year. That certainly beats the loss of about 5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Tek Seng Holdings Berhad better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Tek Seng Holdings Berhad you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Tek Seng Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tek Seng Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:TEKSENG

Tek Seng Holdings Berhad

An investment holding company, manufactures and trades in polyvinyl chloride (PVC) related products and polypropylene (PP) non-woven products.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026