- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:MAXLAND

Priceworth International Berhad (KLSE:PWORTH) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

Priceworth International Berhad (KLSE:PWORTH) shares have had a horrible month, losing 26% after a relatively good period beforehand. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

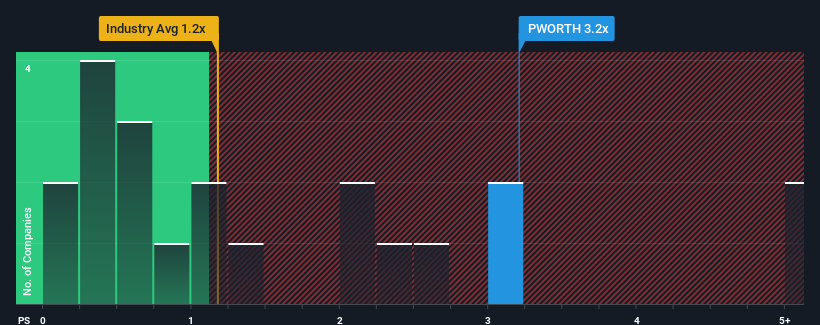

Although its price has dipped substantially, when almost half of the companies in Malaysia's Forestry industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Priceworth International Berhad as a stock not worth researching with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Priceworth International Berhad

What Does Priceworth International Berhad's P/S Mean For Shareholders?

For instance, Priceworth International Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Priceworth International Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Priceworth International Berhad's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 49%. Even so, admirably revenue has lifted 135% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 9.6% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Priceworth International Berhad's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Priceworth International Berhad's P/S

Even after such a strong price drop, Priceworth International Berhad's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Priceworth International Berhad can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about these 4 warning signs we've spotted with Priceworth International Berhad (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on Priceworth International Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MAXLAND

Maxland Berhad

An investment holding company, manufactures and sells wood products in Malaysia, Japan, Taiwan, Korea, India, and internationally.

Mediocre balance sheet low.