- Malaysia

- /

- Metals and Mining

- /

- KLSE:PERSTIM

Perusahaan Sadur Timah Malaysia (Perstima) Berhad's (KLSE:PERSTIM) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Most readers would already be aware that Perusahaan Sadur Timah Malaysia (Perstima) Berhad's (KLSE:PERSTIM) stock increased significantly by 19% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to Perusahaan Sadur Timah Malaysia (Perstima) Berhad's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Perusahaan Sadur Timah Malaysia (Perstima) Berhad

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Perusahaan Sadur Timah Malaysia (Perstima) Berhad is:

8.8% = RM37m ÷ RM416m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.09 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Perusahaan Sadur Timah Malaysia (Perstima) Berhad's Earnings Growth And 8.8% ROE

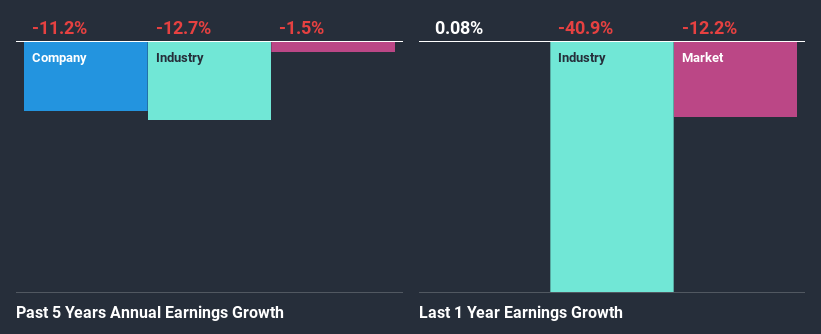

On the face of it, Perusahaan Sadur Timah Malaysia (Perstima) Berhad's ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 3.0%, is definitely interesting. But then again, seeing that Perusahaan Sadur Timah Malaysia (Perstima) Berhad's net income shrunk at a rate of 11% in the past five years, makes us think again. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

Next, on comparing with the industry net income growth, we found that Perusahaan Sadur Timah Malaysia (Perstima) Berhad's earnings seems to be shrinking at a similar rate as the industry which shrunk at a rate of a rate of 13% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Perusahaan Sadur Timah Malaysia (Perstima) Berhad fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Perusahaan Sadur Timah Malaysia (Perstima) Berhad Making Efficient Use Of Its Profits?

With a high three-year median payout ratio of 73% (implying that 27% of the profits are retained), most of Perusahaan Sadur Timah Malaysia (Perstima) Berhad's profits are being paid to shareholders, which explains the company's shrinking earnings. With only very little left to reinvest into the business, growth in earnings is far from likely. You can see the 3 risks we have identified for Perusahaan Sadur Timah Malaysia (Perstima) Berhad by visiting our risks dashboard for free on our platform here.

Additionally, Perusahaan Sadur Timah Malaysia (Perstima) Berhad has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

Overall, we have mixed feelings about Perusahaan Sadur Timah Malaysia (Perstima) Berhad. Primarily, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE. Bear in mind, the company reinvests a small portion of its profits, which explains the lack of growth. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Perusahaan Sadur Timah Malaysia (Perstima) Berhad and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading Perusahaan Sadur Timah Malaysia (Perstima) Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PERSTIM

Perusahaan Sadur Timah Malaysia (Perstima) Berhad

Manufactures and sells tinplates and tin free steel products in Malaysia, Vietnam, the Philippines, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives