- Malaysia

- /

- Metals and Mining

- /

- KLSE:PANTECH

Pantech Group Holdings Berhad (KLSE:PANTECH) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Pantech Group Holdings Berhad (KLSE:PANTECH) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Pantech Group Holdings Berhad

How Much Debt Does Pantech Group Holdings Berhad Carry?

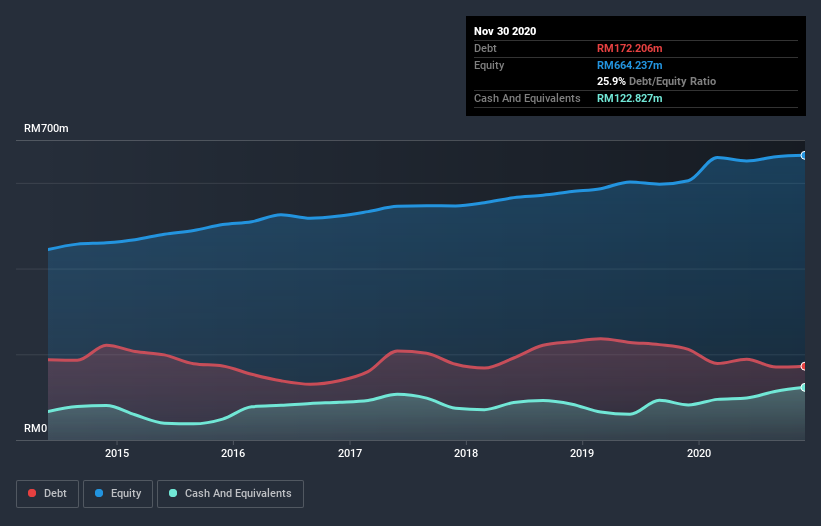

You can click the graphic below for the historical numbers, but it shows that Pantech Group Holdings Berhad had RM172.2m of debt in November 2020, down from RM211.5m, one year before. However, because it has a cash reserve of RM122.8m, its net debt is less, at about RM49.4m.

How Healthy Is Pantech Group Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Pantech Group Holdings Berhad had liabilities of RM175.6m due within 12 months, and liabilities of RM67.0m due beyond 12 months. Offsetting these obligations, it had cash of RM122.8m as well as receivables valued at RM137.8m due within 12 months. So it actually has RM18.0m more liquid assets than total liabilities.

This short term liquidity is a sign that Pantech Group Holdings Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Pantech Group Holdings Berhad's low debt to EBITDA ratio of 1.00 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.6 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Importantly, Pantech Group Holdings Berhad's EBIT fell a jaw-dropping 40% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Pantech Group Holdings Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Pantech Group Holdings Berhad produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Pantech Group Holdings Berhad's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that Pantech Group Holdings Berhad is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Pantech Group Holdings Berhad that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Pantech Group Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PANTECH

Pantech Group Holdings Berhad

An investment holding company, manufactures and sells steel pipes, fittings, flanges, valves, and other related products in Malaysia, the Republic of Singapore, the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026