- Malaysia

- /

- Metals and Mining

- /

- KLSE:PA

Why Investors Shouldn't Be Surprised By P.A. Resources Berhad's (KLSE:PA) 27% Share Price Plunge

The P.A. Resources Berhad (KLSE:PA) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

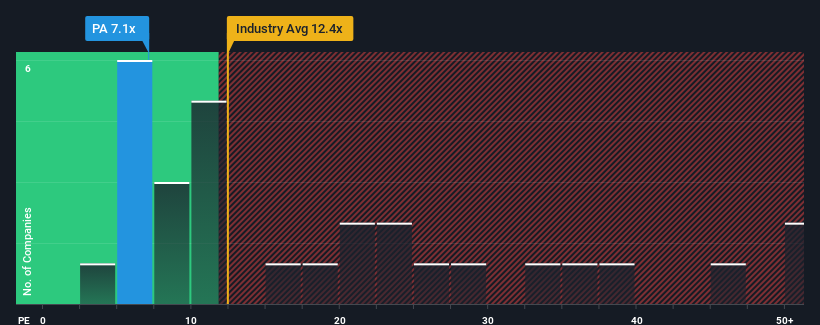

In spite of the heavy fall in price, P.A. Resources Berhad may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.1x, since almost half of all companies in Malaysia have P/E ratios greater than 15x and even P/E's higher than 25x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for P.A. Resources Berhad as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for P.A. Resources Berhad

How Is P.A. Resources Berhad's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as P.A. Resources Berhad's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 73%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's an unpleasant look.

With this information, we are not surprised that P.A. Resources Berhad is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On P.A. Resources Berhad's P/E

P.A. Resources Berhad's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of P.A. Resources Berhad revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - P.A. Resources Berhad has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PA

P.A. Resources Berhad

An investment holding company, provides aluminum extrusion, fabrication, and related services in Malaysia and the United States.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026