If You Like EPS Growth Then Check Out Ornapaper Berhad (KLSE:ORNA) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Ornapaper Berhad (KLSE:ORNA). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Ornapaper Berhad

How Fast Is Ornapaper Berhad Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Ornapaper Berhad managed to grow EPS by 4.8% per year, over three years. While that sort of growth rate isn't amazing, it does show the business is growing.

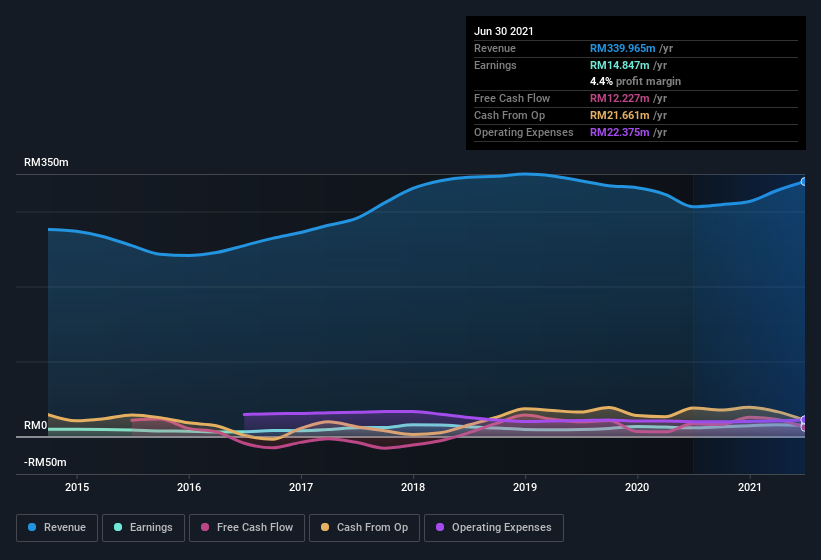

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Ornapaper Berhad maintained stable EBIT margins over the last year, all while growing revenue 11% to RM340m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Ornapaper Berhad is no giant, with a market capitalization of RM112m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Ornapaper Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Ornapaper Berhad insiders own a significant number of shares certainly appeals to me. In fact, they own 46% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only RM112m Ornapaper Berhad is really small for a listed company. So despite a large proportional holding, insiders only have RM52m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Ornapaper Berhad with market caps under RM829m is about RM537k.

The CEO of Ornapaper Berhad was paid just RM2.5k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Ornapaper Berhad Worth Keeping An Eye On?

One important encouraging feature of Ornapaper Berhad is that it is growing profits. The fact that EPS is growing is a genuine positive for Ornapaper Berhad, but the pretty picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. What about risks? Every company has them, and we've spotted 2 warning signs for Ornapaper Berhad you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ORNA

Ornapaper Berhad

Engages in the manufacture and sale of corrugated boards and carton boxes for the manufacturing sector in Malaysia, rest of Asia, and the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives