- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:MENTIGA

Mentiga Corporation Berhad (KLSE:MENTIGA) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Mentiga Corporation Berhad (KLSE:MENTIGA) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Mentiga Corporation Berhad

What Is Mentiga Corporation Berhad's Debt?

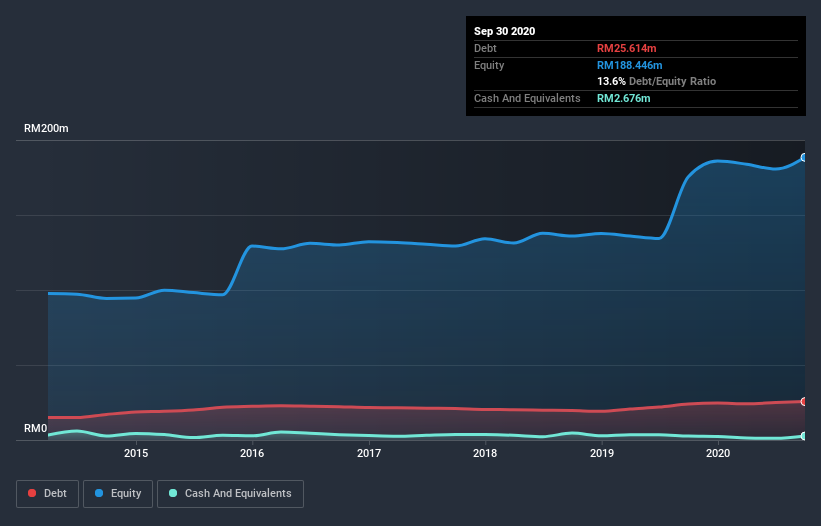

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Mentiga Corporation Berhad had RM25.6m of debt, an increase on RM24.0m, over one year. However, it also had RM2.68m in cash, and so its net debt is RM22.9m.

A Look At Mentiga Corporation Berhad's Liabilities

According to the last reported balance sheet, Mentiga Corporation Berhad had liabilities of RM23.4m due within 12 months, and liabilities of RM50.4m due beyond 12 months. On the other hand, it had cash of RM2.68m and RM8.49m worth of receivables due within a year. So its liabilities total RM62.6m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RM63.5m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Mentiga Corporation Berhad's moderate net debt to EBITDA ratio ( being 1.7), indicates prudence when it comes to debt. And its commanding EBIT of 96.4 times its interest expense, implies the debt load is as light as a peacock feather. Although Mentiga Corporation Berhad made a loss at the EBIT level, last year, it was also good to see that it generated RM9.4m in EBIT over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Mentiga Corporation Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Mentiga Corporation Berhad recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

We'd go so far as to say Mentiga Corporation Berhad's conversion of EBIT to free cash flow was disappointing. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Mentiga Corporation Berhad's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with Mentiga Corporation Berhad , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Mentiga Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MENTIGA

Mentiga Corporation Berhad

An investment holding company, primarily engages in the oil palm plantation business in Malaysia.

Slight and overvalued.

Market Insights

Community Narratives