- Malaysia

- /

- Metals and Mining

- /

- KLSE:LBALUM

Shareholders May Find It Hard To Justify A Pay Rise For LB Aluminium Berhad's (KLSE:LBALUM) CEO This Year

Key Insights

- LB Aluminium Berhad's Annual General Meeting to take place on 25th of September

- CEO Mark Wing's total compensation includes salary of RM636.0k

- The overall pay is comparable to the industry average

- LB Aluminium Berhad's total shareholder return over the past three years was 3.2% while its EPS was down 11% over the past three years

Under the guidance of CEO Mark Wing, LB Aluminium Berhad (KLSE:LBALUM) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 25th of September. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for LB Aluminium Berhad

Comparing LB Aluminium Berhad's CEO Compensation With The Industry

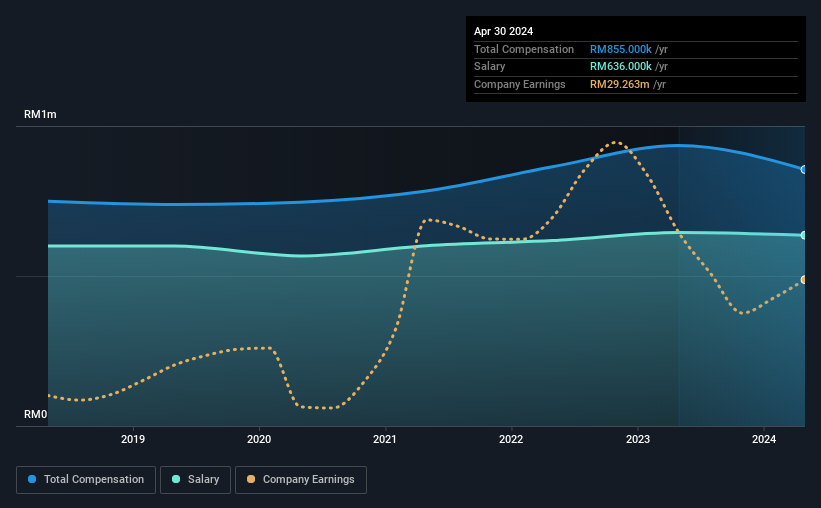

Our data indicates that LB Aluminium Berhad has a market capitalization of RM230m, and total annual CEO compensation was reported as RM855k for the year to April 2024. We note that's a decrease of 8.6% compared to last year. Notably, the salary which is RM636.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Malaysian Metals and Mining industry with market capitalizations below RM849m, we found that the median total CEO compensation was RM702k. So it looks like LB Aluminium Berhad compensates Mark Wing in line with the median for the industry. Furthermore, Mark Wing directly owns RM3.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM636k | RM645k | 74% |

| Other | RM219k | RM290k | 26% |

| Total Compensation | RM855k | RM935k | 100% |

On an industry level, roughly 73% of total compensation represents salary and 27% is other remuneration. LB Aluminium Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

LB Aluminium Berhad's Growth

LB Aluminium Berhad has reduced its earnings per share by 11% a year over the last three years. In the last year, its revenue is up 23%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has LB Aluminium Berhad Been A Good Investment?

LB Aluminium Berhad has generated a total shareholder return of 3.2% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Although the company has performed relatively well, we still think there are some areas that could be improved. Still, we think that until shareholders see an improvement in EPS growth, they may find it hard to justify a pay rise for the CEO.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 4 warning signs (and 1 which is potentially serious) in LB Aluminium Berhad we think you should know about.

Important note: LB Aluminium Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LBALUM

LB Aluminium Berhad

Manufactures and trades in aluminum extrusion and other metal products worldwide.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives