Here's Why We Think Karyon Industries Berhad (KLSE:KARYON) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Karyon Industries Berhad (KLSE:KARYON). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Karyon Industries Berhad

How Quickly Is Karyon Industries Berhad Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Karyon Industries Berhad's EPS has grown 20% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

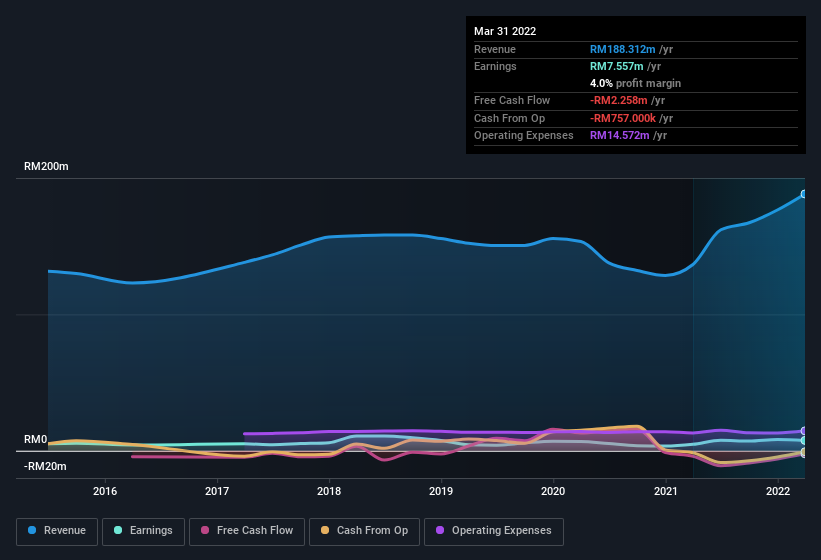

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Karyon Industries Berhad remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 38% to RM188m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Karyon Industries Berhad isn't a huge company, given its market capitalisation of RM81m. That makes it extra important to check on its balance sheet strength.

Are Karyon Industries Berhad Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Karyon Industries Berhad will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only RM81m Karyon Industries Berhad is really small for a listed company. So this large proportion of shares owned by insiders only amounts to RM35m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is Karyon Industries Berhad Worth Keeping An Eye On?

For growth investors, Karyon Industries Berhad's raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Before you take the next step you should know about the 3 warning signs for Karyon Industries Berhad (1 can't be ignored!) that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Karyon Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KARYON

Karyon Industries Berhad

An investment holding company, manufactures and trades polymeric products in Malaysia, rest of Asia, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026