- Malaysia

- /

- Basic Materials

- /

- KLSE:XIN

Jade Marvel Group Berhad's (KLSE:JADEM) 40% Share Price Plunge Could Signal Some Risk

The Jade Marvel Group Berhad (KLSE:JADEM) share price has fared very poorly over the last month, falling by a substantial 40%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

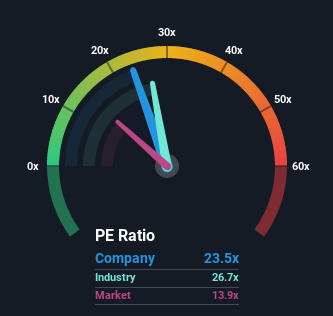

Even after such a large drop in price, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 13x, you may still consider Jade Marvel Group Berhad as a stock to avoid entirely with its 23.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Jade Marvel Group Berhad certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Jade Marvel Group Berhad

How Is Jade Marvel Group Berhad's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Jade Marvel Group Berhad's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 60% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Jade Marvel Group Berhad's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Jade Marvel Group Berhad's P/E?

A significant share price dive has done very little to deflate Jade Marvel Group Berhad's very lofty P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jade Marvel Group Berhad revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 3 warning signs we've spotted with Jade Marvel Group Berhad.

If you're unsure about the strength of Jade Marvel Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XIN

Xin Synergy Group Berhad

An investment holding company, manufactures and supply Asphaltic concrete and aggregates primarily in Malaysia.

Excellent balance sheet low.