Here's What We Learned About The CEO Pay At Imaspro Corporation Berhad (KLSE:IMASPRO)

Chin Tong has been the CEO of Imaspro Corporation Berhad (KLSE:IMASPRO) since 2005, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Imaspro Corporation Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Imaspro Corporation Berhad

How Does Total Compensation For Chin Tong Compare With Other Companies In The Industry?

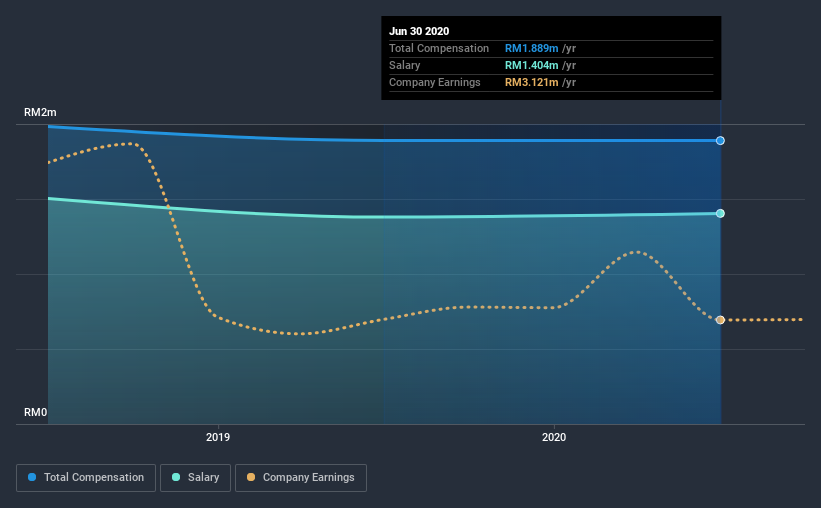

According to our data, Imaspro Corporation Berhad has a market capitalization of RM167m, and paid its CEO total annual compensation worth RM1.9m over the year to June 2020. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at RM1.40m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below RM815m, reported a median total CEO compensation of RM739k. Accordingly, our analysis reveals that Imaspro Corporation Berhad pays Chin Tong north of the industry median. Moreover, Chin Tong also holds RM11m worth of Imaspro Corporation Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM1.4m | RM1.4m | 74% |

| Other | RM485k | RM510k | 26% |

| Total Compensation | RM1.9m | RM1.9m | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. It's interesting to note that Imaspro Corporation Berhad pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Imaspro Corporation Berhad's Growth

Over the last three years, Imaspro Corporation Berhad has shrunk its earnings per share by 10% per year. Its revenue is down 12% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Imaspro Corporation Berhad Been A Good Investment?

Imaspro Corporation Berhad has served shareholders reasonably well, with a total return of 19% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

As we noted earlier, Imaspro Corporation Berhad pays its CEO higher than the norm for similar-sized companies belonging to the same industry. This doesn't look great when you realize that the company has been suffering from negative EPS growth for the last three years. And shareholder returns are decent but not great. So we think more research is needed, but we don't think the CEO is underpaid.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Imaspro Corporation Berhad you should be aware of, and 1 of them is a bit unpleasant.

Switching gears from Imaspro Corporation Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Imaspro Corporation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:IMASPRO

Imaspro Corporation Berhad

An investment holding company, engages in the manufacture and distribution of agrochemicals, public health, and environmental science products in Malaysia, Indonesia, Russia, the Philippines, Australia, Cambodia, China, Lebanon, Singapore, Taiwan, New Zealand, and Vietnam.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives