- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:HEVEA

HeveaBoard Berhad's (KLSE:HEVEA) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

HeveaBoard Berhad (KLSE:HEVEA) has had a great run on the share market with its stock up by a significant 65% over the last three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. Specifically, we decided to study HeveaBoard Berhad's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for HeveaBoard Berhad

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for HeveaBoard Berhad is:

3.1% = RM13m ÷ RM422m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every MYR1 worth of equity, the company was able to earn MYR0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

HeveaBoard Berhad's Earnings Growth And 3.1% ROE

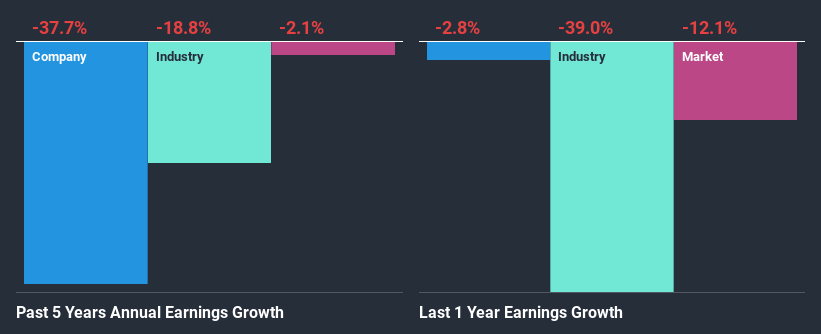

It is hard to argue that HeveaBoard Berhad's ROE is much good in and of itself. Not just that, even compared to the industry average of 4.2%, the company's ROE is entirely unremarkable. For this reason, HeveaBoard Berhad's five year net income decline of 38% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 19% in the same period, we still found HeveaBoard Berhad's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about HeveaBoard Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is HeveaBoard Berhad Making Efficient Use Of Its Profits?

HeveaBoard Berhad's high three-year median payout ratio of 138% suggests that the company is depleting its resources to keep up its dividend payments, and this shows in its shrinking earnings. Paying a dividend higher than reported profits is not a sustainable move. To know the 2 risks we have identified for HeveaBoard Berhad visit our risks dashboard for free.

Additionally, HeveaBoard Berhad has paid dividends over a period of nine years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 91% over the next three years. As a result, the expected drop in HeveaBoard Berhad's payout ratio explains the anticipated rise in the company's future ROE to 4.2%, over the same period.

Summary

Overall, we would be extremely cautious before making any decision on HeveaBoard Berhad. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade HeveaBoard Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HeveaBoard Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:HEVEA

HeveaBoard Berhad

An investment holding company, manufactures, trades in, and distributes particleboards and particleboard-based products.

Adequate balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026