- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:DOMINAN

Dominant Enterprise Berhad's (KLSE:DOMINAN) Upcoming Dividend Will Be Larger Than Last Year's

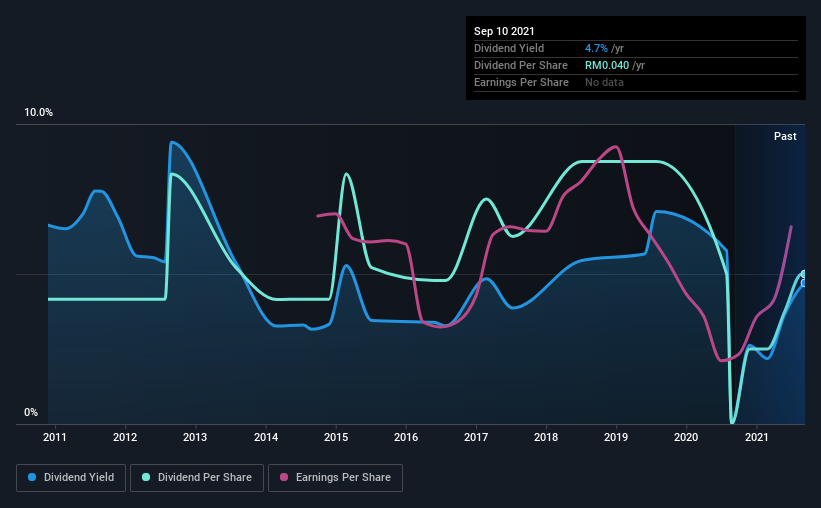

Dominant Enterprise Berhad (KLSE:DOMINAN) will increase its dividend on the 22nd of October to RM0.01. The announced payment will take the dividend yield to 4.7%, which is in line with the average for the industry.

See our latest analysis for Dominant Enterprise Berhad

Dominant Enterprise Berhad's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. Dominant Enterprise Berhad is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

Looking forward, earnings per share could rise by 15.3% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 24%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The dividend has gone from RM0.033 in 2011 to the most recent annual payment of RM0.04. This implies that the company grew its distributions at a yearly rate of about 1.9% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see Dominant Enterprise Berhad has been growing its earnings per share at 15% a year over the past five years. Dominant Enterprise Berhad definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 5 warning signs for Dominant Enterprise Berhad you should be aware of, and 3 of them can't be ignored. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:DOMINAN

Dominant Enterprise Berhad

An investment holding company, manufactures and sells mouldings and furniture components, and laminated wood panel products in Malaysia, Australia, Singapore, Vietnam, and Thailand.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026