- Malaysia

- /

- Metals and Mining

- /

- KLSE:CORAZA

Coraza Integrated Technology Berhad (KLSE:CORAZA) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

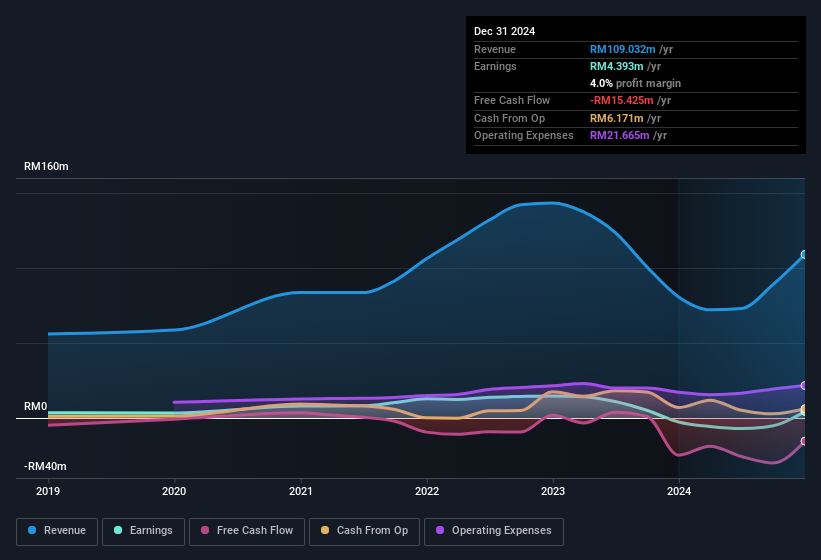

Coraza Integrated Technology Berhad's (KLSE:CORAZA) stock was strong after they recently reported robust earnings. However, we think that shareholders may be missing some concerning details in the numbers.

Our free stock report includes 2 warning signs investors should be aware of before investing in Coraza Integrated Technology Berhad. Read for free now.

An Unusual Tax Situation

We can see that Coraza Integrated Technology Berhad received a tax benefit of RM3.4m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Coraza Integrated Technology Berhad's Profit Performance

In its most recent report, Coraza Integrated Technology Berhad disclosed a tax benefit, as we discussed above. Given that sort of benefit is not recurring, it's safe to say the statutory profit overstates its underlying profitability quite significantly. As a result, we think it may well be the case that Coraza Integrated Technology Berhad's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Coraza Integrated Technology Berhad at this point in time. You'd be interested to know, that we found 2 warning signs for Coraza Integrated Technology Berhad and you'll want to know about them.

Today we've zoomed in on a single data point to better understand the nature of Coraza Integrated Technology Berhad's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Coraza Integrated Technology Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CORAZA

Coraza Integrated Technology Berhad

An investment holding company, provides integrated engineering services in Malaysia, Singapore, the United States, China, European countries, and rest of Asian countries.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives