- Malaysia

- /

- Basic Materials

- /

- KLSE:CMSB

Cahya Mata Sarawak Berhad (KLSE:CMSB) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Cahya Mata Sarawak Berhad (KLSE:CMSB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Cahya Mata Sarawak Berhad

How Much Debt Does Cahya Mata Sarawak Berhad Carry?

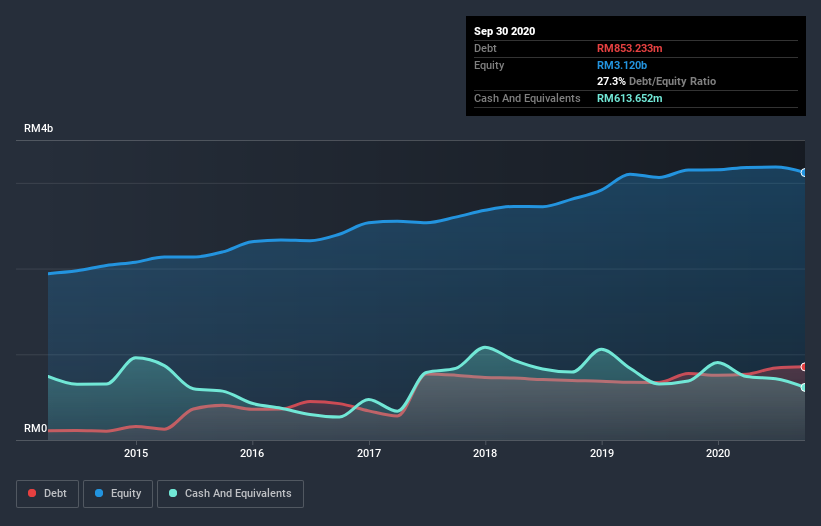

The image below, which you can click on for greater detail, shows that at September 2020 Cahya Mata Sarawak Berhad had debt of RM853.2m, up from RM775.2m in one year. However, it also had RM613.7m in cash, and so its net debt is RM239.6m.

How Healthy Is Cahya Mata Sarawak Berhad's Balance Sheet?

We can see from the most recent balance sheet that Cahya Mata Sarawak Berhad had liabilities of RM545.7m falling due within a year, and liabilities of RM868.8m due beyond that. On the other hand, it had cash of RM613.7m and RM327.7m worth of receivables due within a year. So its liabilities total RM473.1m more than the combination of its cash and short-term receivables.

Given Cahya Mata Sarawak Berhad has a market capitalization of RM2.45b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 1.4 and interest cover of 2.6 times, it seems to us that Cahya Mata Sarawak Berhad is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Shareholders should be aware that Cahya Mata Sarawak Berhad's EBIT was down 65% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Cahya Mata Sarawak Berhad can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Cahya Mata Sarawak Berhad recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Cahya Mata Sarawak Berhad's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Cahya Mata Sarawak Berhad has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Cahya Mata Sarawak Berhad that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Cahya Mata Sarawak Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CMSB

Cahya Mata Sarawak Berhad

An investment holding company, engages in the manufacture and trading of cement and construction materials in Malaysia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)