Is Box-Pak (Malaysia) Bhd (KLSE:BOXPAK) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Box-Pak (Malaysia) Bhd. (KLSE:BOXPAK) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Box-Pak (Malaysia) Bhd

How Much Debt Does Box-Pak (Malaysia) Bhd Carry?

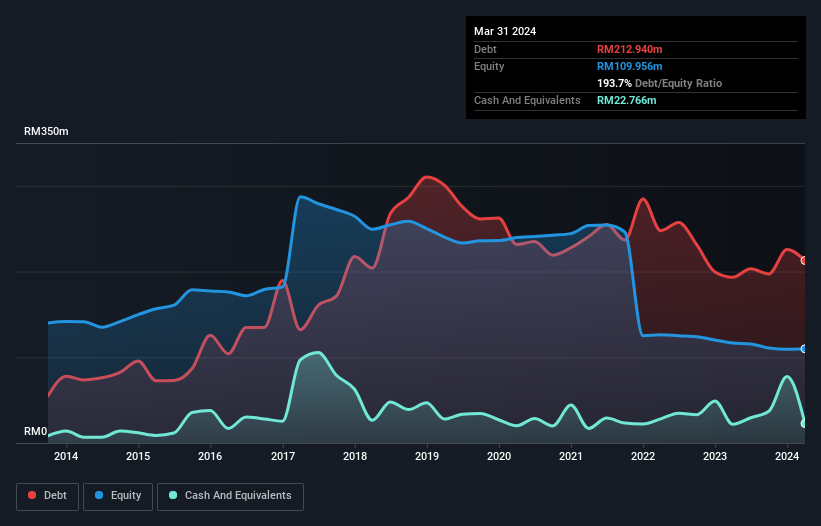

As you can see below, at the end of March 2024, Box-Pak (Malaysia) Bhd had RM212.9m of debt, up from RM193.3m a year ago. Click the image for more detail. On the flip side, it has RM22.8m in cash leading to net debt of about RM190.2m.

How Strong Is Box-Pak (Malaysia) Bhd's Balance Sheet?

We can see from the most recent balance sheet that Box-Pak (Malaysia) Bhd had liabilities of RM316.6m falling due within a year, and liabilities of RM49.3m due beyond that. Offsetting this, it had RM22.8m in cash and RM152.7m in receivables that were due within 12 months. So its liabilities total RM190.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the RM86.4m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Box-Pak (Malaysia) Bhd would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Box-Pak (Malaysia) Bhd's debt to EBITDA ratio (4.7) suggests that it uses some debt, its interest cover is very weak, at 0.88, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. The silver lining is that Box-Pak (Malaysia) Bhd grew its EBIT by 128% last year, which nourishing like the idealism of youth. If that earnings trend continues it will make its debt load much more manageable in the future. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Box-Pak (Malaysia) Bhd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Box-Pak (Malaysia) Bhd actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We feel some trepidation about Box-Pak (Malaysia) Bhd's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Box-Pak (Malaysia) Bhd is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Box-Pak (Malaysia) Bhd you should be aware of, and 2 of them can't be ignored.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Box-Pak (Malaysia) Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:BOXPAK

Box-Pak (Malaysia) Bhd

An investment holding company, engages in the manufacture and distribution of paper boxes, cartons, general papers, and board printing products in Malaysia, Vietnam, and Myanmar.

Low and slightly overvalued.