These 4 Measures Indicate That Asia Poly Holdings Berhad (KLSE:ASIAPLY) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Asia Poly Holdings Berhad (KLSE:ASIAPLY) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Asia Poly Holdings Berhad

What Is Asia Poly Holdings Berhad's Debt?

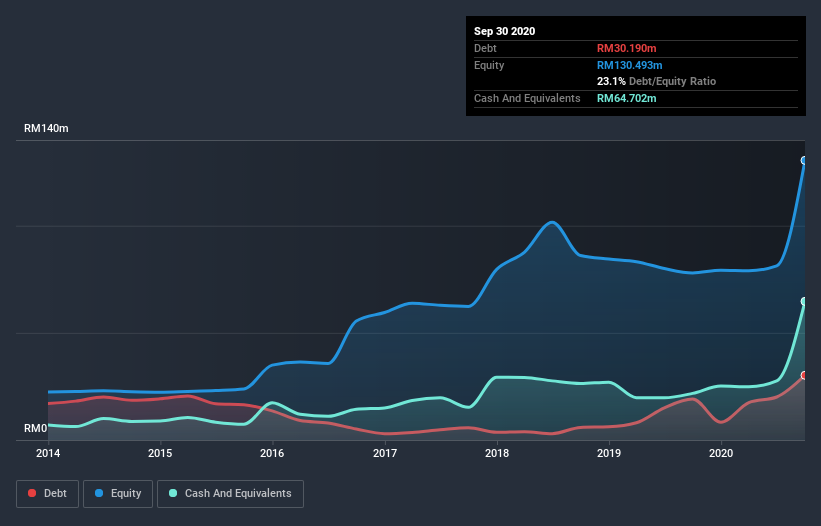

As you can see below, at the end of September 2020, Asia Poly Holdings Berhad had RM30.2m of debt, up from RM19.1m a year ago. Click the image for more detail. But it also has RM64.7m in cash to offset that, meaning it has RM34.5m net cash.

How Healthy Is Asia Poly Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Asia Poly Holdings Berhad had liabilities of RM39.2m due within 12 months, and liabilities of RM23.2m due beyond 12 months. On the other hand, it had cash of RM64.7m and RM17.5m worth of receivables due within a year. So it can boast RM19.8m more liquid assets than total liabilities.

This short term liquidity is a sign that Asia Poly Holdings Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Asia Poly Holdings Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

We also note that Asia Poly Holdings Berhad improved its EBIT from a last year's loss to a positive RM5.0m. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Asia Poly Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Asia Poly Holdings Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, Asia Poly Holdings Berhad actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While it is always sensible to investigate a company's debt, in this case Asia Poly Holdings Berhad has RM34.5m in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of RM23m, being 467% of its EBIT. So is Asia Poly Holdings Berhad's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Asia Poly Holdings Berhad (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Asia Poly Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ASIAPLY

Asia Poly Holdings Berhad

An investment holding company, engages in the manufacture and sale of cell cast acrylic sheets.

Slight with imperfect balance sheet.