- Malaysia

- /

- Metals and Mining

- /

- KLSE:ALCOM

Alcom Group Berhad (KLSE:ALCOM) Has Announced That Its Dividend Will Be Reduced To MYR0.03

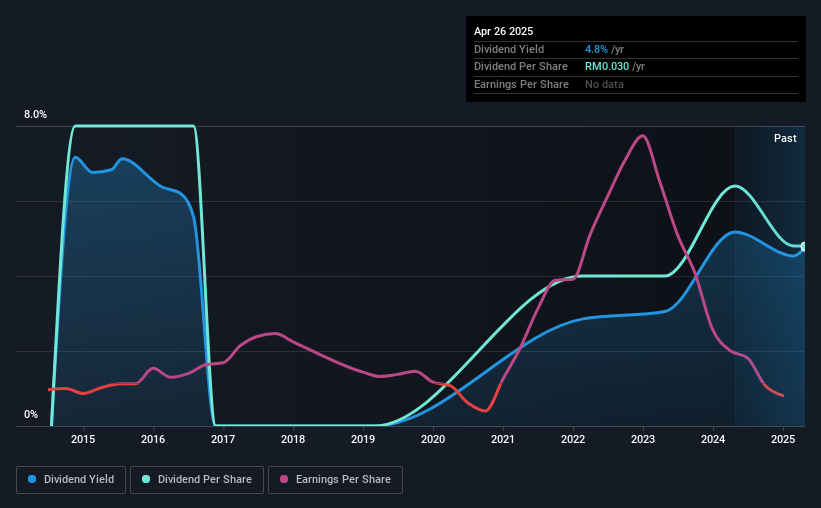

Alcom Group Berhad (KLSE:ALCOM) is reducing its dividend from last year's comparable payment to MYR0.03 on the 25th of July. The dividend yield of 4.8% is still a nice boost to shareholder returns, despite the cut.

Our free stock report includes 3 warning signs investors should be aware of before investing in Alcom Group Berhad. Read for free now.Alcom Group Berhad's Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. Despite not generating a profit, Alcom Group Berhad is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Over the next year, EPS could expand by 14.0% if recent trends continue. This is the right direction to be moving, but it is probably not enough to achieve profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

View our latest analysis for Alcom Group Berhad

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of MYR0.05 in 2015 to the most recent total annual payment of MYR0.03. Doing the maths, this is a decline of about 5.0% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Alcom Group Berhad has seen EPS rising for the last five years, at 14% per annum. It's not an ideal situation that the company isn't turning a profit but the growth recently is a positive sign. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

The Dividend Could Prove To Be Unreliable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Alcom Group Berhad has 3 warning signs (and 2 which don't sit too well with us) we think you should know about. Is Alcom Group Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ALCOM

Alcom Group Berhad

An investment holding company, manufactures and trades aluminum sheet and coils products in Malaysia, the United States, Thailand, India, rest of Asia, Europe, the Middle East, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026