MNRB Holdings Berhad's (KLSE:MNRB) Price Is Out Of Tune With Revenues

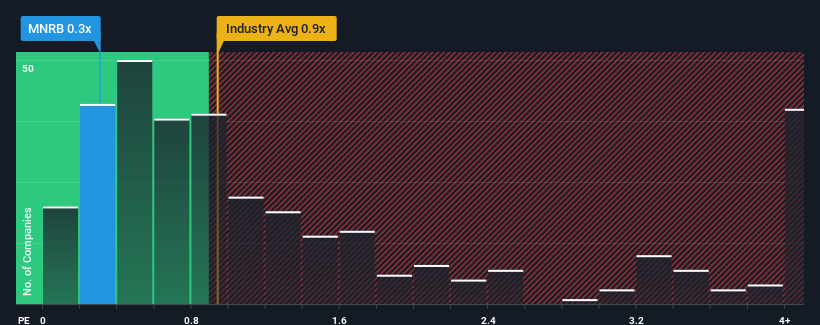

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Insurance industry in Malaysia, you could be forgiven for feeling indifferent about MNRB Holdings Berhad's (KLSE:MNRB) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for MNRB Holdings Berhad

What Does MNRB Holdings Berhad's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, MNRB Holdings Berhad has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think MNRB Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For MNRB Holdings Berhad?

MNRB Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 85% as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to moderate by 2.0%, which indicates the company should perform poorly indeed.

With this information, it's perhaps strange that MNRB Holdings Berhad is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On MNRB Holdings Berhad's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

MNRB Holdings Berhad currently trades on a higher P/S than expected based on revenue decline, even more so since its revenue forecast is even worse than the struggling industry. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. In addition, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 4 warning signs for MNRB Holdings Berhad (2 are a bit concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MNRB

MNRB Holdings Berhad

An investment holding company, engages in the general reinsurance, takaful, and retakaful businesses in Malaysia and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives