MNRB Holdings Berhad (KLSE:MNRB) Held Back By Insufficient Growth Even After Shares Climb 38%

MNRB Holdings Berhad (KLSE:MNRB) shares have continued their recent momentum with a 38% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

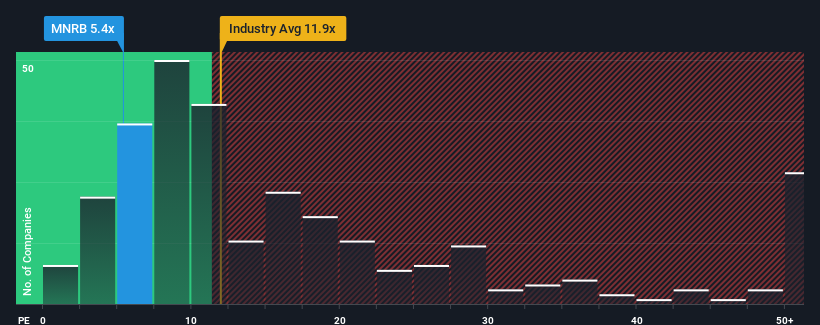

Even after such a large jump in price, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 16x, you may still consider MNRB Holdings Berhad as a highly attractive investment with its 5.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for MNRB Holdings Berhad as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for MNRB Holdings Berhad

How Is MNRB Holdings Berhad's Growth Trending?

MNRB Holdings Berhad's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 171% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 43% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 23% during the coming year according to the sole analyst following the company. With the market predicted to deliver 15% growth , that's a disappointing outcome.

In light of this, it's understandable that MNRB Holdings Berhad's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From MNRB Holdings Berhad's P/E?

MNRB Holdings Berhad's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MNRB Holdings Berhad's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for MNRB Holdings Berhad (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, you might also be able to find a better stock than MNRB Holdings Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MNRB

MNRB Holdings Berhad

An investment holding company, engages in the general reinsurance, takaful, and retakaful businesses in Malaysia and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives