- Malaysia

- /

- Household Products

- /

- KLSE:HEXCARE

Hextar Healthcare Berhad (KLSE:HEXCARE) shareholders are up 12% this past week, but still in the red over the last three years

It's nice to see the Hextar Healthcare Berhad (KLSE:HEXCARE) share price up 12% in a week. But that doesn't change the fact that the returns over the last three years have been stomach churning. Indeed, the share price is down a whopping 72% in the last three years. Arguably, the recent bounce is to be expected after such a bad drop. Of course the real question is whether the business can sustain a turnaround.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Hextar Healthcare Berhad

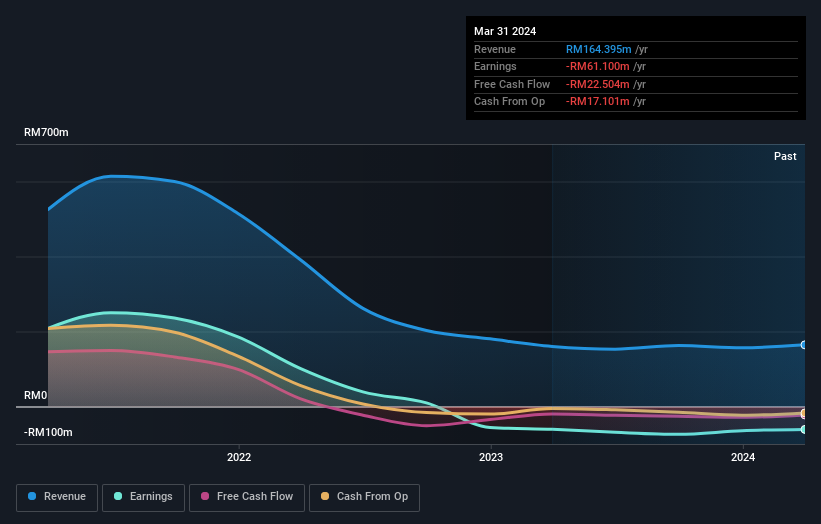

Because Hextar Healthcare Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Hextar Healthcare Berhad's revenue dropped 55% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 20% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Hextar Healthcare Berhad shareholders are up 4.5% for the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 10% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Hextar Healthcare Berhad better, we need to consider many other factors. For instance, we've identified 4 warning signs for Hextar Healthcare Berhad (1 can't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hextar Healthcare Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HEXCARE

Hextar Healthcare Berhad

An investment holding company, produces, sells, and exports household gloves, industrial gloves, and nitrile disposable gloves in Europe, Asia, North and South America, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives