- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

Top Glove Corporation Bhd. (KLSE:TOPGLOV) Screens Well But There Might Be A Catch

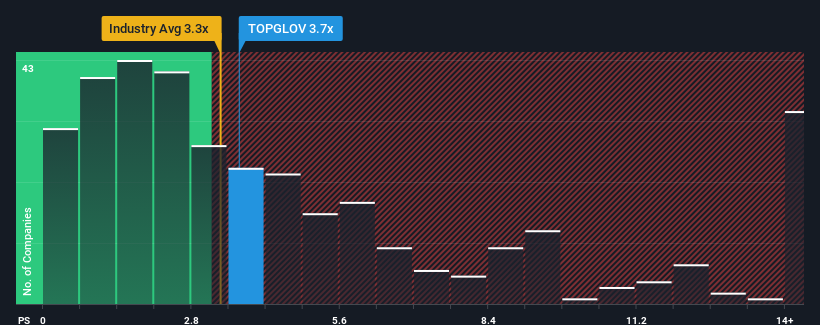

It's not a stretch to say that Top Glove Corporation Bhd.'s (KLSE:TOPGLOV) price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" for companies in the Medical Equipment industry in Malaysia, where the median P/S ratio is around 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Top Glove Corporation Bhd

What Does Top Glove Corporation Bhd's Recent Performance Look Like?

Recent times have been pleasing for Top Glove Corporation Bhd as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Top Glove Corporation Bhd will help you uncover what's on the horizon.How Is Top Glove Corporation Bhd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Top Glove Corporation Bhd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Still, lamentably revenue has fallen 85% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 28% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we find it interesting that Top Glove Corporation Bhd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Top Glove Corporation Bhd's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Top Glove Corporation Bhd's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Top Glove Corporation Bhd has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Top Glove Corporation Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives