- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

Top Glove Corporation Bhd (KLSE:TOPGLOV) Is Growing Earnings But Are They A Good Guide?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Top Glove Corporation Bhd (KLSE:TOPGLOV).

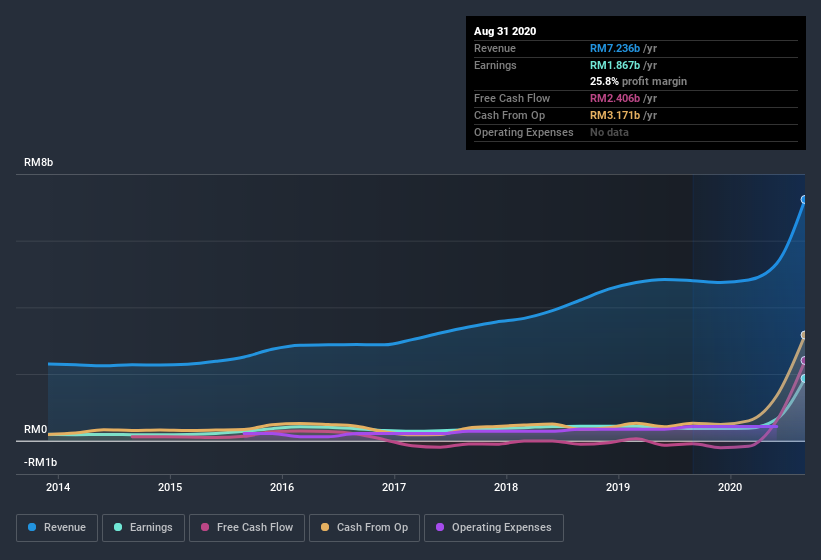

We like the fact that Top Glove Corporation Bhd made a profit of RM1.87b on its revenue of RM7.24b, in the last year. We know some investors love those high revenue growth stocks, but we do like to look at profit, even if it is, perhaps, a bit old fashioned. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

View our latest analysis for Top Glove Corporation Bhd

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, we'll today take a look at how dilution and cashflow shape our understanding of Top Glove Corporation Bhd's earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Zooming In On Top Glove Corporation Bhd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Top Glove Corporation Bhd has an accrual ratio of -0.12 for the year to August 2020. Therefore, its statutory earnings were quite a lot less than its free cashflow. In fact, it had free cash flow of RM2.4b in the last year, which was a lot more than its statutory profit of RM1.87b. Given that Top Glove Corporation Bhd had negative free cash flow in the prior corresponding period, the trailing twelve month resul of RM2.4b would seem to be a step in the right direction. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Top Glove Corporation Bhd expanded the number of shares on issue by 6.0% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Top Glove Corporation Bhd's EPS by clicking here.

How Is Dilution Impacting Top Glove Corporation Bhd's Earnings Per Share? (EPS)

Top Glove Corporation Bhd has improved its profit over the last three years, with an annualized gain of 464% in that time. In comparison, earnings per share only gained 435% over the same period. And the 412% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 390% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So Top Glove Corporation Bhd shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Top Glove Corporation Bhd's Profit Performance

In conclusion, Top Glove Corporation Bhd has strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share growth is weaker than its profit growth. Considering the aforementioned, we think that Top Glove Corporation Bhd's profits are probably a reasonable reflection of its underlying profitability; although we'd be confident in that conclusion if we saw a cleaner set of results. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Be aware that Top Glove Corporation Bhd is showing 3 warning signs in our investment analysis and 1 of those doesn't sit too well with us...

Our examination of Top Glove Corporation Bhd has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Top Glove Corporation Bhd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Top Glove Corporation Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

High growth potential with adequate balance sheet.