- Malaysia

- /

- Medical Equipment

- /

- KLSE:TOPGLOV

Is Top Glove Corporation Bhd (KLSE:TOPGLOV) Using Debt Sensibly?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Top Glove Corporation Bhd. (KLSE:TOPGLOV) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Top Glove Corporation Bhd

What Is Top Glove Corporation Bhd's Debt?

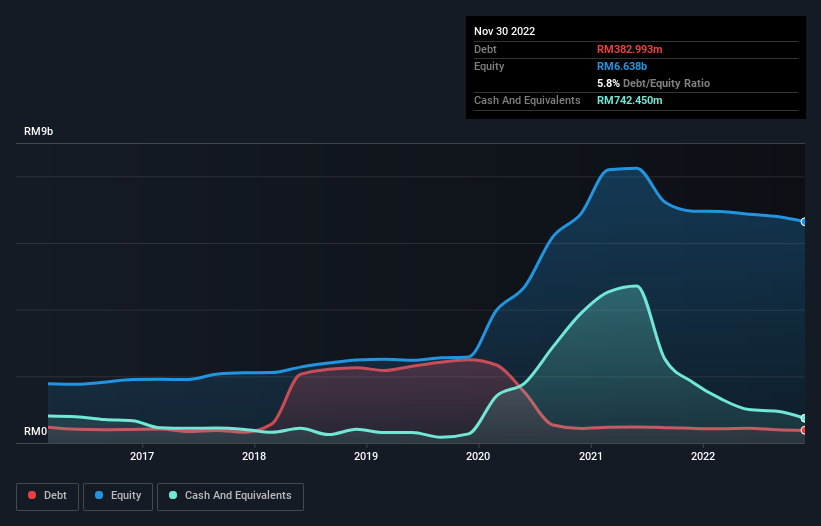

You can click the graphic below for the historical numbers, but it shows that Top Glove Corporation Bhd had RM383.0m of debt in November 2022, down from RM439.1m, one year before. However, its balance sheet shows it holds RM742.5m in cash, so it actually has RM359.5m net cash.

How Strong Is Top Glove Corporation Bhd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Top Glove Corporation Bhd had liabilities of RM771.3m due within 12 months and liabilities of RM309.3m due beyond that. Offsetting this, it had RM742.5m in cash and RM433.7m in receivables that were due within 12 months. So it actually has RM95.6m more liquid assets than total liabilities.

Having regard to Top Glove Corporation Bhd's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the RM6.65b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Top Glove Corporation Bhd boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Top Glove Corporation Bhd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Top Glove Corporation Bhd made a loss at the EBIT level, and saw its revenue drop to RM4.6b, which is a fall of 65%. To be frank that doesn't bode well.

So How Risky Is Top Glove Corporation Bhd?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Top Glove Corporation Bhd had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through RM719m of cash and made a loss of RM128m. Given it only has net cash of RM359.5m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Top Glove Corporation Bhd is showing 1 warning sign in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Top Glove Corporation Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TOPGLOV

Top Glove Corporation Bhd

An investment holding company, manufactures, trades in, and sells gloves in Malaysia, Thailand, the People’s Republic of China, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives